Introduction

Finance leaders are excited about AI, and their teams are ready to embrace it. According to our report, The State of AI in FP&A, more than 80% of those surveyed have begun to incorporate AI in their workflows.

However, we learned that current adoption is very much a “DIY AI” approach—use cases that are relatively easy to implement with widely accessible AI tools like ChatGPT and other LLMs.

This approach makes sense as it allows teams to become more familiar with AI and achieve some quick wins. However, the data still lives in silos, and manually stitching it together in order to prompt an LLM limits the transformative potential of AI.

The real breakthrough will come from finance-native platforms that blend AI with deep financial context, robust controls, and seamless integration.

Finance leaders intuitively know this and are beginning to explore AI-powered finance management tools to support more sophisticated, strategic AI use cases.

The problem? They’re running into a complex mix of vendors whose AI capabilities are often unclear or overhyped.

This guide provides an in-depth look at all the different categories of software companies use today to manage their finances, examines how AI is being incorporated into tools in each category, and explains how AI-powered tools can help you transform the finance function in your organization.

AI use cases in finance today

1. Financial planning and analysis (FP&A) software

FP&A represents one of the most mature areas for AI implementation in finance, where machine learning (ML) models are transforming how organizations forecast and plan. Modern AI-powered FP&A platforms can generate rolling forecasts that automatically incorporate real-time data feeds, seasonal patterns, and market conditions to predict revenue, expenses, and cash flow with improved accuracy. These systems excel at scenario analysis, running ‘what-if’ simulations to help finance teams understand potential outcomes under different market conditions or strategic decisions.

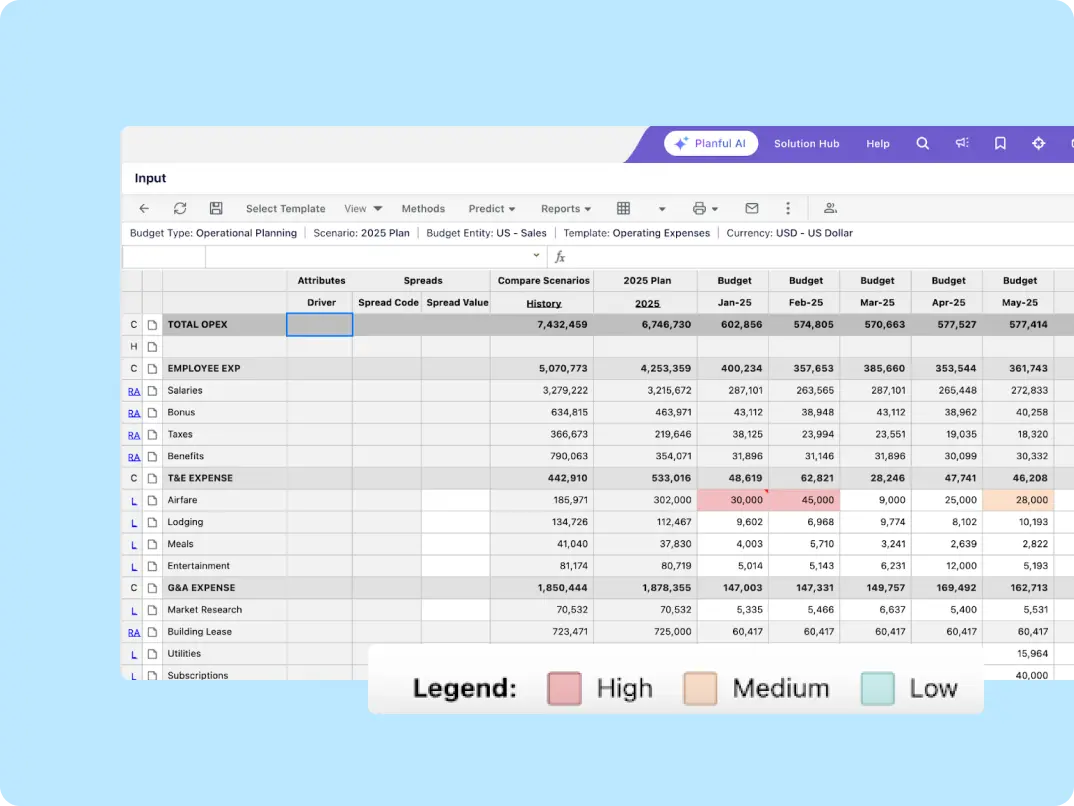

One of the most powerful uses of AI in FP&A is when combined with driver-based planning capabilities. For example, AI algorithms can identify which business metrics, from website traffic to customer acquisition costs, most strongly correlate with financial performance. Instead of relying on traditional top-down budgeting, finance teams can now build models that automatically adjust forecasts when key business drivers change, creating a more dynamic and responsive planning process.

2. Accounting and Enterprise Resource Planning (ERP) software

AI is changing the game in core accounting processes by automating the most time-consuming and error-prone tasks that have traditionally required manual intervention. Automated transaction classification uses ML to categorize incoming transactions with greater accuracy than human accountants, automatically sorting thousands of entries while flagging unusual patterns that might indicate errors or fraud. These systems continuously learn from corrections and approvals, becoming more accurate over time and reducing the need for manual review.

Intelligent reconciliation capabilities use pattern recognition to match transactions between ledgers and bank statements, even when data formats differ or amounts don’t exactly align due to timing differences or fees. Compliance monitoring features track regulatory changes across multiple jurisdictions and automatically scan accounting entries for violations of new rules or accounting standards, to reduce month-end close times while improving accuracy and reducing audit risk.

3. Billing and invoicing software

Smart invoice extraction capabilities have transformed how organizations handle incoming invoices and billing documents. AI-powered OCR systems can extract detailed invoice information, amounts, dates, vendor details, and line items from scanned documents, PDFs, or emailed files.

Payment prediction models analyze customer behavior patterns, payment history, and external factors to forecast which invoices are likely to be paid late, enabling finance teams to prioritize collection efforts and improve cash flow management. Anomaly detection algorithms continuously monitor billing patterns to identify unusual charges, duplicate invoices, or potential fraud in outgoing invoices before they impact customer relationships or revenue recognition.

4. Accounts payable (AP) automation software

AP automation platforms now incorporate sophisticated fraud detection algorithms that monitor transactions for patterns suggesting fraudulent activity, analyzing vendor information, payment amounts, and invoice characteristics to identify suspicious submissions in real-time.

Invoice approval routing uses ML to analyze invoice content and historical approval patterns to suggest optimal approval workflows automatically. Rather than relying on rigid, rules-based routing, AI systems learn from past decisions and can intelligently route invoices to the right approvers while predicting potential bottlenecks. Duplicate payment prevention features use advanced pattern recognition to flag duplicate or erroneous payments before processing.

5. Revenue recognition software

Contract data extraction capabilities use natural language processing (NLP) to read and parse customer contracts, automatically identifying key dates, terms, performance obligations, and payment schedules relevant to revenue recognition. This is particularly valuable for businesses with complex subscription models or multi-element arrangements where revenue recognition rules vary significantly by contract type. AI systems can process hundreds of contracts simultaneously, extracting critical information that would take accounting teams weeks to review manually.

Automated schedule creation uses ML to generate revenue recognition schedules based on contract structure and identified performance obligations. AI-powered compliance checks continuously monitor revenue recognition events against standards like ASC 606 and IFRS 15, flagging potential issues before they become audit findings and ensuring consistent application of recognition rules across all contracts and business units.

6. Cap table management software

Stakeholder analysis features use AI to analyze ownership trends and model the impact of fundraising rounds, stock grants, or warrant exercises on existing shareholder dilution. These systems can process complex ownership structures and automatically calculate dilution effects across different classes of shares, helping companies understand how various corporate actions will impact existing stakeholders.

Scenario modeling capabilities use ML to project possible outcomes for funding rounds, exits, and employee option exercises, allowing companies to test various financing structures and see their impact on ownership, valuation, and potential returns. Error detection algorithms continuously monitor cap table data for inconsistencies in share allocations, vesting schedules, or mathematical calculations that could create compliance issues or disputes with investors and employees.

7. Financial close and consolidation software

Close task automation uses AI to handle repetitive close activities like accruals, allocations, and eliminations that traditionally require significant manual effort each month. By automating these routine tasks, finance teams can focus on higher-value analysis and exception handling rather than data manipulation.

Variance analysis capabilities use AI to compare actuals against forecasts and budgets, automatically flagging significant exceptions and unusual fluctuations for review. Advanced systems can provide intelligent explanations for variances by analyzing underlying business drivers and identifying the root causes of deviations from plan. Continuous close features use ML to orchestrate near real-time reconciliation of transactions, enabling a ‘continuous close’ process that provides up-to-date financial positions.

8. Corporate credit card and expense management software

Receipt matching technology uses AI to automatically match submitted receipts with transaction data. Expense policy enforcement features use ML to review expenses for compliance with company policies, automatically flagging violations while learning from historical approval patterns to reduce false positives. These systems can adapt to legitimate business reasons for exceptions and understand context around spending that might appear to violate policy but is actually justified.

Fraudulent expense detection algorithms monitor spending patterns across the organization to identify suspicious activity such as duplicate claims, unauthorized vendors, or unusual spending behaviors that might indicate expense fraud or policy abuse.

9. Sales tax compliance software

Jurisdiction assignment uses AI to determine the correct taxing jurisdiction based on transaction details like customer location, product type, and delivery address, ensuring accurate tax rates are applied automatically. As businesses expand across states and countries, AI-powered jurisdiction assignment becomes critical for maintaining compliance without manual intervention.

Tax rate updates leverage ML to track regulatory changes across thousands of jurisdictions and automatically update tax rates when new rules take effect. Audit readiness features use AI to scan transaction histories for potential compliance risks, automatically preparing documentation and supporting records that auditors typically request, significantly reducing the time and effort required during tax examinations.

10. Treasury management system (TMS)

Cash forecasting uses AI to predict future cash flow by analyzing current balances, accounts payable and receivables, historical payment patterns, and external economic factors. These models can incorporate seasonality, customer-specific payment behaviors, and market conditions to provide increasingly accurate forecasts that help teams make informed decisions about liquidity needs and investment opportunities.

Liquidity optimization features use ML to analyze available cash and investment options, automatically suggesting optimal short-term investments and borrowing.

Risk management capabilities use AI to assess exposure to currency fluctuations, interest rate changes, and credit risk across the organization’s financial positions, automatically suggesting hedging strategies and mitigation approaches to protect against adverse market movements.

Building an AI-powered finance tech stack

There are certain core software categories that every business today must have. If you’re a CFO planning to integrate AI into your finance operations, the smartest approach is to evaluate AI-enabled solutions in these essential categories first. Why buy twice when you can build for the future from day one?

Beyond the obvious finance-specific tools, there are several adjacent software categories that play a crucial role in managing your company’s overall financial health.

The table below shows our top picks across all these categories, highlighting the AI capabilities that set them apart from traditional solutions.

| Finance Software Category | Description | Our Top AI Software Picks |

|---|---|---|

| FP&A software | Streamlines budgeting, forecasting, and financial analysis | Drivetrain • Automatically consolidates financial data from ERP, CRM, HRIS, and billing systems. • One-click model generation with intelligent metric selection and business logic • Conversational AI assistant for querying models and variance analysis • Predictive analytics for real-time anomaly detection and performance monitoring • AI-driven root cause analysis with automated variance explanations |

| Accounting software or ERP | Tracks financial transactions and helps manage the operational aspects of business finances. | NetSuite •Uses predictive analytics and ML for cash flow optimization, predicting cash inflows/outflows, surfacing shortfalls, and suggesting optimal payment timing using transactional data and historical trends. • AP/AR automation uses robotic process automation (RPA) to expedite approval workflows and ML to optimize categorization and detect duplicates and exceptions. • Applies ML and predictive analytics to historical and real-time financial data to create revenue, cash flow, and demand forecasts and alert users to variances. Rillet • Uses ML models for continuous transaction matching and reconciliation with anomaly detection. • Predictive analytics identify potential bottlenecks in close processes, outlier transactions, and proactively execute close routines (“zero-day close”). • Uses rule-based AI and ML to dynamically allocate revenue per contracts, schedules, usage, or milestones, auto-adjusting for ASC 606/IFRS 15 changes. |

| Billing and invoicing software | Automates and streamlines tasks like creating and sending invoices, tracking payments, and managing customer billing. | Zuora Billing • Decision-tree AI and predictive modeling are used to analyze payment failure reasons and recommend or schedule smart retries or alternative payment methods. • Uses ML to review customer or product usage data to highlight underbilling or overbilling risks and recommend plan adjustments. AI determines when/how to batch, format, and distribute complex invoices (multi-entity, multi-currency, by usage or milestone). |

| Accounts payable (AP) automation software | Automates and streamlines AP processes, capturing bills, routing approvals, managing spend, and issuing payments. | BILL • Combines optical character recognition (OCR) and ML-based data extraction to capture invoices. • Uses predictive analytics and pattern recognition for automated invoice coding and classification, and vendor matching. • Anomaly detection algorithms and rule-based AI to check for fraud and duplicate invoices. |

| Revenue recognition software | Streamlines revenue management to allocate, reconcile, monitor, and recognize revenue while staying compliant. | Maxio • Rules-based AI automatically parses contract data to identify revenue streams, deliverables, and recognition events. • Combines predictive analytics and pattern recognition to predict recognized vs. deferred revenue and cash flow impacts • Uses event-driven workflow automation and historical pattern logic to dynamically recalculate revenue schedules when contracts are modified |

| Cap table management software | Maintains and updates a company's ownership structure, like share issuance, options granted, transfers, and equity transactions. | Carta • Combines rules-based AI with anomaly detection to automatically verify option allocations, vesting schedules, and participant data and flag errors or inconsistencies. • Uses AI to flag, correct, or suggest fixes for duplicate, incomplete, or conflicting historical data during onboarding or cap table migration. • Monitors platform access and workflow activity to detect anomalies or unauthorized actions, and ensures an audit-ready log is maintained. |

| Financial close & consolidation software | Supports general bookkeeping for monthly close, reconciliation, and workflow management. | FloQast • Sends AI-driven follow-ups & communication. • ML auto-matches transactions and learns from prior matches to automate common reconciliation patterns. • ML leverages past cycle data to predict late/missed reconciliations using past cycle data and alert users to likely timeline/risk issues in advance. |

| Corporate credit card & expense management software | Tracks all the transactions made through corporate cards to help identify spending patterns. | Ramp • AI monitors card transactions in real time, flagging out-of-policy spend, duplicate transactions, and suspicious activity for review. • Analyzes spend patterns, subscriptions, and vendor relationships to recommend savings or optimize recurring expenses. • AI oversees transaction approvals and budget thresholds, auto-notifying users and managers when limits are approached or exceeded. |

| Sales tax compliance software | Tracks state and local sales and uses taxes to support reporting and audits for better tax compliance. | Avalara •Combines rules-based AI and geospatial data mapping to automatically determine the correct sales tax rate. • Monitors transactional data and customer locations, applying ML to detect when a customer crosses economic nexus thresholds, triggering new tax obligations. • AI checks for anomalies, mismatches, and missing transaction data, providing audit-ready sales tax reporting. |

| Treasury management system (TMS) | Centralizes and automates cash, liquidity, banking, and financial risk management. | Kyriba • Combines ML-based matching and anomaly detection for bank reconciliation. • Uses AI-driven aggregation and scenario modeling for cash forecasting. • Provides automated exposure detection and optimization for FX hedging. |

Key considerations when choosing AI tools for your tech stack

Building trustworthy, future-ready financial operations starts with three essentials: choosing the right AI capabilities, ensuring transparency through explainable and auditable systems, and maintaining strong security. Each of these directly influences compliance, operational efficiency, and ultimately how well you can turn AI into a real business advantage.

Identifying the right mix of AI capabilities you need

Selecting the right blend of AI capabilities for your finance team is foundational, as it ensures the software addresses both your current needs and future growth. Finance environments are evolving rapidly, so your AI should handle immediate use cases like automating invoice processing or fraud detection while also supporting anticipated developments like predictive forecasting or intelligent scenario modeling. By mapping out both present and future AI use cases, you maximize ROI and avoid buying software that quickly becomes obsolete or fails to scale with your operations.

The ability of AI-enabled tools to integrate with your existing tech stack is equally vital. Modern finance teams juggle multiple software platforms, ERP systems, CRM tools, and specialized accounting software. Seamless integration ensures data flows smoothly between systems, reduces manual entry, and eliminates data silos that hurt both efficiency and accuracy. Strong interoperability also lets you gradually adopt and expand AI functionality without major disruptions or the need to rip and replace legacy systems, protecting your existing investments and workflows.

Explainable AI

Explainable AI—its reliability and auditability—is crucial in finance because AI-driven decisions can have serious monetary and regulatory consequences. When AI models are transparent and their outputs are understandable, finance professionals can grasp the logic behind recommendations or automated actions. This builds trust in the system and allows users to catch errors, biases, or inconsistencies before they impact business outcomes. Reliability improves because users can validate that the AI actually works as expected in real-world situations.

Auditability is equally important as finance operations face internal audits, external scrutiny, and regulatory review. AI-enabled systems must produce clear records showing how they reach decisions, which transactions they influence, and what data they use. This audit trail ensures compliance and accountability, enabling teams to defend their processes when questioned and continuously improve their AI strategies by learning from past performance.

Security

While security is always important for business software, it's absolutely critical for AI-enabled finance tools. These systems handle sensitive financial data, personally identifiable information, and proprietary business insights. Any vulnerability could trigger financial losses, regulatory penalties, or serious reputational damage. Strong security measures protect data confidentiality, integrity, and availability while safeguarding against unauthorized access, cyberattacks, internal misuse, and data breaches.

AI systems introduce unique security risks that traditional software doesn’t introduce, like adversarial attacks on ML models or manipulation of automated decision-making processes. You need comprehensive security policies, including encryption, robust access controls, and continuous monitoring to maintain trust and meet legal requirements. Don’t forget to thoroughly vet your vendors’ security posture before implementation; ensure they follow industry standards and can demonstrate rigorous safeguards throughout the entire AI software lifecycle.

Automation and how it factors into AI enablement

AI in finance doesn’t technically require automation to come first, but in practice, most AI applications work much better when built on top of automated systems. Automation creates the structured processes and clean data flows that AI can then analyze, enhance, or optimize. Think of automation as laying the groundwork—it’s hard to get meaningful insights from AI if your data is still trapped in manual processes or inconsistent formats.

Most successful AI projects in corporate finance start by automating key workflows like data extraction, reconciliation, or transaction processing. This creates consistent, standardized data streams that AI models can actually learn from and act on. For example, before using AI to forecast cash flow, you typically need to automate how you collect and classify transactions. Without that foundation, your AI is working with incomplete or unreliable inputs.

That said, some AI applications can function without extensive prior automation. AI can analyze historical financial statements, detect anomalies in messy datasets, or generate insights from raw, unstructured data. Early exploratory use cases, like spend pattern analysis or risk modeling, can often run before your processes are fully automated.

Automation and AI are most powerful when they work together. Automation handles the repetitive work, reduces errors, and enables real-time data access. AI builds on that foundation, adding intelligence, learning, prediction, pattern recognition, and prescriptive analytics.

Be careful not to confuse basic automation with actual AI. Many finance solutions marketed as ‘AI-powered’ simply automate repetitive tasks like batch payment processing or rule-based approval workflows without any adaptive or learning component. These systems increase speed and reduce errors, but they don’t ‘learn’ or provide insights beyond their original programming.

True AI applications go further. They might suggest new fraud controls after detecting suspicious patterns, continuously optimize liquidity strategies, or offer predictive insights about vendor risk based on evolving market conditions. These systems use advanced algorithms, ML, and statistical modeling, not just automated rules.

Top tools for each category of financial software

The finance software landscape is crowded with vendors claiming AI capabilities. Some offer genuine ML that adapts and improves over time, while others simply rebrand basic automation as ‘AI-powered.’

The tools below represent our top picks across each category, vendors that demonstrate real AI functionality that can meaningfully impact your finance operations.

Drivetrain stands out as a genuinely AI-native business planning platform designed specifically for modern finance teams who need sophisticated modeling capabilities without the traditional complexity.

Unlike legacy FP&A tools that bolt on AI features as an afterthought, Drivetrain’s core architecture was built to incorporate AI. Drive AI offers a comprehensive suite of AI-powered tools that fundamentally change how financial models are created, monitored, and adjusted. The platform excels at eliminating the manual grunt work that typically consumes a big chunk of an analyst’s time, allowing finance teams to focus on strategic analysis rather than data wrangling. What sets Drivetrain apart is its ability to understand financial relationships and business logic automatically, creating models that are faster to build, more accurate, and insightful than traditional approaches.

AI Transforms: Automatically converts complex financial datasets from multiple sources into usable model parameters in seconds, eliminating time-consuming data consolidation processes.

AI Model Generator: Builds comprehensive first-cut models in one click using integrated ERP, CRM, HRIS, and billing data with intelligent metric selection and business logic.

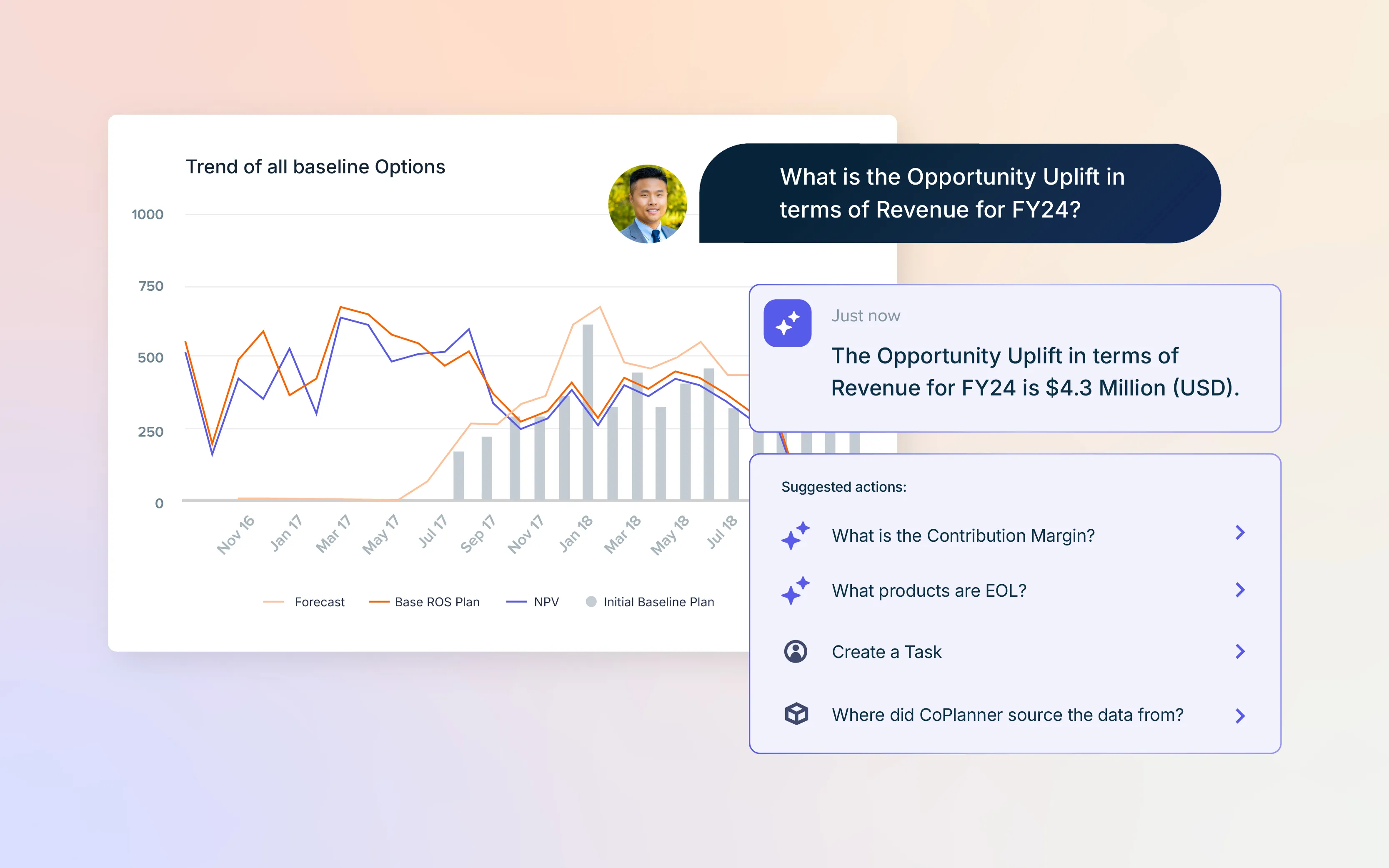

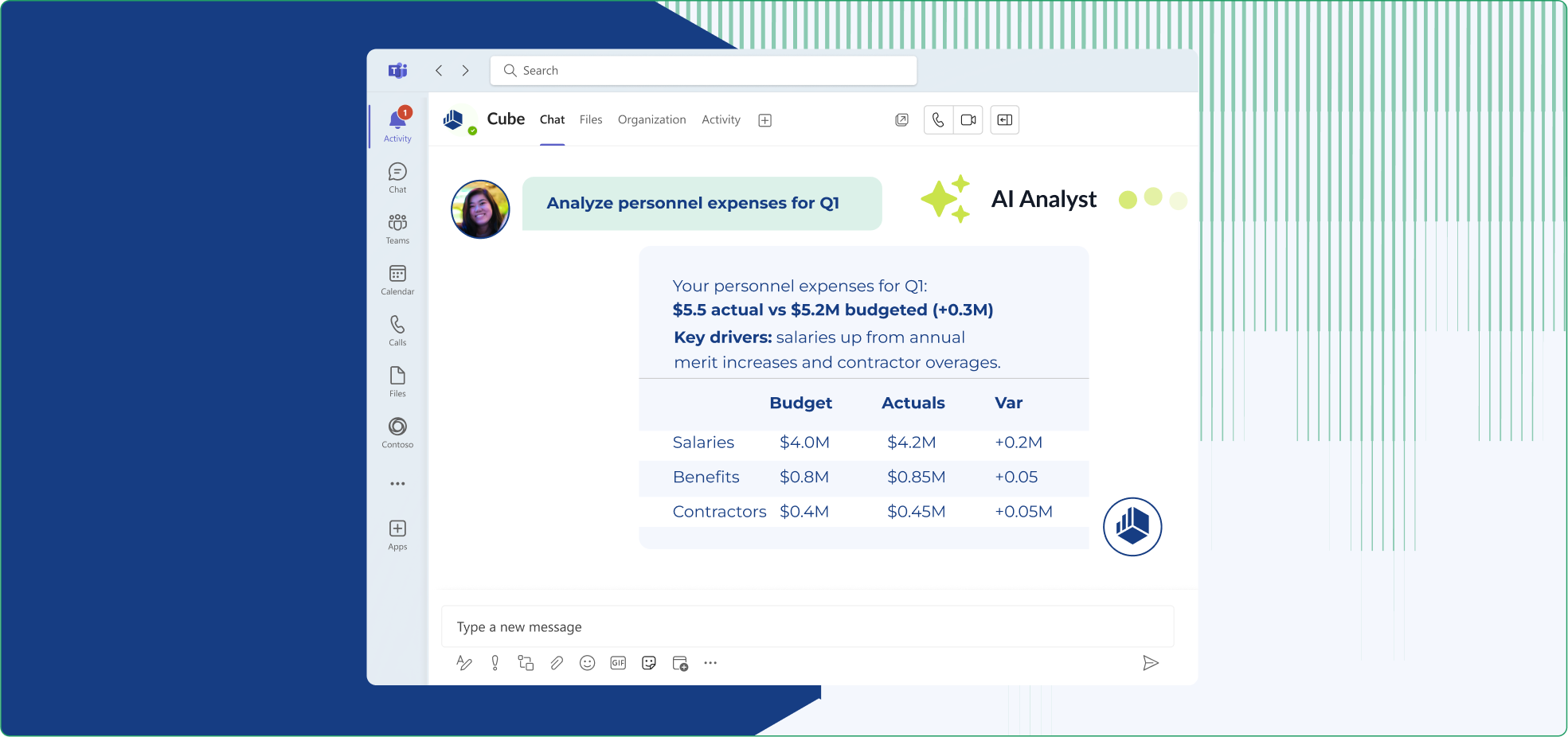

AI Analyst: Serves as a virtual modeling assistant, enabling natural language queries about model performance, variances, and sensitivity analysis without manual calculations.

AI Alerts: Monitors financial model performance in real-time, proactively flagging significant variances and potential issues before they impact strategic decisions.

AI BvA: Quickly identifies root causes behind budget vs. actual variances with clear explanations to accelerate decision-making and improve forecast accuracy.

NetSuite stands as one of the most established cloud ERP solutions, offering robust and scalable financial management capabilities specifically built for mid-market and enterprise demands. What distinguishes NetSuite is its systematic integration of artificial intelligence across core finance and accounting functions.

The system excels at handling complex, multi-subsidiary operations with deep compliance features and extensive customization options that have made it the go-to choice for established businesses with intricate processes. NetSuite's strength lies in its maturity and proven track record. It can handle virtually any business scenario, backed by a vast ecosystem of partners and integrators who can customize it to meet specific industry needs.

Intelligent transaction categorization: Uses ML to automatically recognize and classify expense types, invoice details, and GL code assignments based on historical patterns.

Predictive analytics engine: Forecasts revenue, cash flow, and critical metrics by analyzing historical and current data while proactively flagging variances and risks.

AI-powered financial close: Combines RPA and AI to streamline accruals, reconciliations, and allocations while identifying close process bottlenecks and suggesting optimizations.

Anomaly detection: Continuously monitors transactions for outlier activity and potential fraud, providing immediate alerts to strengthen compliance.

Rillet represents a new generation of AI-native ERP built specifically for modern, fast-scaling businesses that want to leapfrog traditional ERP constraints. Unlike platforms that retrofit AI onto legacy architectures, Rillet was designed from the ground up around artificial intelligence. The company touts a 93% automation rate for journal entries and enabling true zero-day closes among its AI achievements.

The platform particularly excels with complex revenue models, multi-entity structures, and high transaction volumes, scenarios where traditional ERPs tend to bog down in manual processes. Rillet’s appeal lies in its ability to deliver enterprise-grade functionality without enterprise-grade complexity, making it especially attractive for CFOs who want to scale rapidly without building large finance teams or enduring lengthy implementation cycles.

End-to-end accounting automation: Processes journal entries without human intervention using AI-driven transaction recognition and categorization.

Zero-day close capability: Enables continuous close processes through real-time AI reconciliation and automated period-end procedures.

Smart revenue recognition: Automatically handles complex subscription and usage-based revenue models with AI-powered contract analysis and scheduling.

Real-time anomaly detection: Continuously monitors financial data for irregularities and provides immediate insights for faster decision-making.

Zuora Billing dominates the enterprise billing space with sophisticated AI-powered capabilities designed for complex, multi-faceted revenue models. Originally built for subscription businesses, Zuora now handles usage-based, one-time, and hybrid billing scenarios at a global scale. The platform excels when organizations need to manage intricate pricing structures, multi-currency operations, or rapidly evolving billing requirements while maintaining compliance across jurisdictions. Zuora’s strength lies in its ability to blend recurring and one-off transactions seamlessly while providing predictive insights that optimize cash flow and reduce collection risks.

Predictive payment analytics: Forecasts customer payment timing, churn likelihood, and recurring billing trends to optimize cash flow planning.

Behavioral dunning optimization: Personalizes collection strategies and reminder sequences based on individual customer payment behaviors and preferences.

Intelligent revenue recognition: Automates complex multi-element revenue arrangements and billing event triggers while ensuring compliance with accounting standards.

Billing anomaly detection: Continuously scans for errors, duplicate charges, and setup inconsistencies to prevent revenue leakage and customer disputes.

BILL transforms traditionally manual AP processes into streamlined digital workflows through advanced AI and ML. The platform uses sophisticated OCR and ML algorithms to automatically extract vendor names, amounts, and dates from invoices while eliminating manual data entry errors. Beyond data capture, BILL’s anomaly detection continuously scans for duplicate invoices and potential fraud, while AI-driven workflow automation learns approval patterns to intelligently route invoices and accelerate payment cycles. The result is a more secure, scalable AP operation that helps businesses achieve efficiency and compliance.

Intelligent invoice processing: Advanced OCR and ML automatically extract critical data from invoices, PDFs, and scanned documents with high accuracy.

Smart workflow automation: Learns organizational approval patterns and intelligently routes invoices while sending automated reminders to reduce bottlenecks.

Fraud prevention: Real-time anomaly detection flags duplicate invoices, unusual patterns, and potential fraudulent activity before payments are processed.

Predictive spend categorization: Automatically categorizes expenses and matches vendors to appropriate GL codes based on historical patterns and transaction analysis.

Maxio specializes in automating revenue recognition for recurring revenue and SaaS businesses through intelligent, rules-based AI that ensures ASC 606/IFRS 15 compliance. The platform automatically parses contracts, identifies performance obligations, and schedules revenue recognition while dynamically updating schedules when contracts change through upgrades or cancellations. What distinguishes Maxio is its combination of workflow automation and pattern-based analytics that detect anomalies, flag incomplete schedules, and provide predictive insights for future revenue streams, enabling finance teams to close faster with confidence.

Intelligent contract parsing: Rule-based AI automatically analyzes contracts to map revenue obligations and create compliant recognition schedules per ASC 606/IFRS 15 standards.

Anomaly detection: Pattern recognition algorithms flag inconsistent schedules, missing contract fields, or unusual setups by comparing against historical data patterns.

Event-driven automation: Monitors contractual milestones and automatically triggers recognition events when performance obligations are met or modified.

Predictive revenue analytics: Forecasts recognized and deferred revenue plus cash flow using historical business patterns and current contract pipeline.

Carta brings intelligent automation to equity and cap table management, addressing critical pain points for growing businesses through rules-based AI and anomaly detection. The platform automatically validates equity grants, vesting schedules, and data entries while flagging inconsistencies before they create downstream problems. Carta’s sophisticated algorithmic simulations enable instant ‘what-if’ analyses for fundraising, secondary sales, or exit events, projecting dilution scenarios for all stakeholders. Event-driven automation handles compliance workflows, vesting reminders, and regulatory requirements, helping companies scale their ownership structures confidently.

Automated data validation: Rules-based AI continuously checks equity grants, vesting schedules, and cap table entries for inconsistencies and compliance violations.

Scenario modeling: Algorithmic simulations instantly project dilution outcomes and ownership changes for fundraising, exits, and secondary transactions.

Compliance automation: Event-driven workflows automatically trigger reminders for vesting dates, expirations, and required approvals while guiding users through regulatory processes.

Security monitoring: Anomaly detection continuously monitors system access and activity patterns to enhance security and maintain audit readiness.

FloQast streamlines month-end close and consolidation processes for mid-market and enterprise companies transitioning from manual, spreadsheet-heavy workflows to intelligent automation. The platform’s AI-driven capabilities speed up reconciliations, task management, and audit preparation while providing real-time visibility through integrated dashboards. FloQast’s AI Agents use NLP to transform data into usable formats and automatically apply accounting assumptions and business rules. With robust ERP integrations and flexible workflows, finance teams gain accuracy and efficiency without overhauling their existing tech stack.

Intelligent reconciliation: ML automates account matching and predicts likely reconciliations based on historical close cycles and patterns.

Anomaly detection: Automatically flags material variances and unexpected fluctuations in financial data that require investigation during the close process.

Workflow optimization: AI surfaces bottlenecks, intelligently assigns tasks, and predicts potential close delays to keep teams on schedule.

Predictive close analytics: Forecasts close timelines and identifies at-risk tasks while continuously learning from past performance to improve future cycles.

Ramp combines corporate cards with AI-driven expense management to automate and optimize corporate spending from transaction to reconciliation. The platform uses sophisticated ML and OCR to automatically capture receipts, categorize transactions, and eliminate manual data entry while enforcing spend policies in real-time. Ramp’s AI continuously monitors spending patterns to flag policy violations, detect anomalies, and identify cost-saving opportunities like redundant subscriptions or vendor renegotiations. With seamless ERP integrations and intuitive interfaces, Ramp helps companies reduce manual work, accelerate close cycles, and maintain compliance.

Intelligent receipt processing: Advanced OCR and ML automatically extract data from receipts and match them to transactions while categorizing expenses by merchant and GL codes.

Real-time policy enforcement: Rule-based AI continuously monitors spending against company policies, automatically flagging violations and managing approval workflows.

Anomaly detection: Pattern recognition identifies duplicate submissions, suspicious charges, and unusual spending behavior for immediate review and fraud prevention.

Predictive spend analytics: Analyzes transaction patterns to recommend cost savings, optimize budgets, and identify vendors for renegotiation opportunities.

Avalara dominates the sales tax automation space with AI-powered compliance tools that handle complex, multi-jurisdictional tax calculations automatically. The platform uses rules-based AI and geospatial mapping to calculate correct sales tax rates for every transaction, while ML analyzes patterns to detect new economic nexus exposures and alert businesses when registration is needed. Avalara automates exemption certificate validation, monitors regulatory changes, and updates tax rates in real-time, freeing teams from manual compliance work while ensuring accurate filings and audit readiness.

Intelligent tax calculation: Rules-based AI automatically determines correct sales tax rates and taxability decisions across thousands of jurisdictions using real-time rate updates.

Nexus detection: ML analyzes transaction patterns to identify new economic nexus exposures and alert businesses when tax registration is required.

Automated compliance workflows: AI-driven systems handle recurring filings, exemption certificate validation, and regulatory change responses without manual intervention.

Anomaly detection: Continuously monitors transactions and filings for errors, inconsistencies, and audit risks while maintaining comprehensive documentation trails.

Kyriba stands as a leading pure-play treasury platform combining cash and liquidity management, payments, and comprehensive risk management for FX, interest rates, and liquidity stress testing. The cloud-native platform offers robust analytics, extensive bank connectivity, and rapid deployment capabilities that serve mid-market to large enterprises. Kyriba’s ‘Trusted Agentic AI’ initiative emphasizes trust, transparency, and regulatory compliance. The platform balances deep risk management capabilities with broad operational functionality, supported by comprehensive training through Kyriba Elevate and continuous AI model refinement based on user feedback.

Predictive cash forecasting: Real-time analytics and ML generate accurate cash flow predictions and scenario planning across multiple entities and currencies.

Intelligent risk management: Optimization algorithms recommend FX hedging strategies and optimal cash positioning while automating liquidity stress testing.

Anomaly detection: Continuously monitors reconciliations, payments, and banking data to detect fraud, errors, or data mismatches before they impact operations.

Trusted agentic AI: Embeds explainability, security, and regulatory compliance into all AI-driven decision rules and recommendations for enhanced transparency.

How Drivetrain is moving businesses forward faster on the road to autonomous finance

When building an AI-powered finance tech stack, the smartest approach is to find software that covers multiple categories and supports various use cases your business will encounter. Rather than cobbling together point solutions from different vendors, you want platforms that can grow with your AI ambitions and deliver value across multiple finance functions.

Drivetrain represents exactly this kind of strategic investment. While it anchors your FP&A needs as a comprehensive planning platform, its AI-native architecture extends value into several of the adjacent categories we’ve discussed. The platform’s AI Transforms capability, for instance, handles the data consolidation challenges typically solved by separate ETL tools, while its automated variance analysis and real-time monitoring compete with dedicated financial close solutions. AI-powered revenue scheduling addresses revenue recognition use cases, and intelligent anomaly detection provides fraud prevention capabilities traditionally found in AP automation tools.

This multi-category functionality matters because finance teams are often resource-constrained, and implementation bandwidth is limited. Instead of managing multiple vendor relationships and integration points, Drivetrain’s AI-native approach lets you implement one platform that immediately enhances several aspects of your finance operation. As AI capabilities continue to evolve rapidly, having a platform built from the ground up around artificial intelligence means you’ll benefit from new features and improvements without the friction of retrofitting AI onto legacy systems.

The autonomous finance vision is more than just about individual AI features. It’s about creating an integrated intelligence layer across your entire finance function. Drivetrain’s approach positions finance teams to move toward this future more efficiently, with one comprehensive platform that grows smarter and more capable over time rather than a collection of disparate tools that may never truly work together.

A week of work done in minutes.

Plan better with Drivetrain.

FAQs

Start by identifying your biggest pain points, whether that’s data consolidation, forecast accuracy, or manual reporting processes. This helps you prioritize which AI capabilities will deliver immediate value versus nice-to-have features.

Focus on concrete demonstrations rather than marketing promises. Ask vendors to show live demos using your actual data structure and see how their AI handles real-world complexities like missing data or multi-entity scenarios. Pay attention to algorithm transparency. Can you understand why the system made certain recommendations? In finance, black-box AI creates audit risks.

Evaluate integration capabilities with your existing ERP, CRM, and data sources. Consider whether the platform requires extensive IT support or can be managed by your finance team. Finally, assess the vendor’s track record with similar companies and their AI development roadmap. You want a partner that will evolve with the rapidly changing landscape.

Explainable AI should top your list. You need to understand how the system reaches its conclusions, especially for audit and compliance purposes. Look for platforms that can clearly explain their recommendations rather than operating as black boxes. This transparency becomes crucial when defending decisions to auditors or regulators.

Strong integration capabilities are equally critical. The software should seamlessly connect with your existing ERP, CRM, and data sources without requiring extensive IT resources. Poor integration leads to data silos and manual workarounds that defeat the purpose of automation.

Data quality requirements deserve serious consideration. AI systems are only as good as their inputs, so evaluate whether the platform can handle your current data landscape or if you’ll need significant data cleanup first. Real-time analytics and dynamic reporting capabilities enable faster decision-making, while robust scenario modeling helps with strategic planning.

Security features can’t be overlooked. Finance data requires enterprise-grade protection, including encryption, access controls, and audit trails. Finally, consider AI copilots that enable self-service reporting and governance tools that provide transparency and risk management capabilities to satisfy both internal oversight and external scrutiny.

Start by identifying platforms that offer documented native integrations with your specific ERP system, whether that’s SAP, Oracle, Microsoft Dynamics, or others. Don’t settle for generic ‘we integrate with everything’ claims; look for detailed integration guides and pre-built connectors that demonstrate the vendor has invested in your specific tech stack.

Verify that the integration supports both historical data imports and ongoing automated synchronization. You need seamless data flow without manual intervention or batch processing delays that create gaps in your reporting. Ask vendors to demonstrate the integration process and show how data flows between systems in real-time.

User-generated content provides invaluable insights into real-world integration experiences. Check platforms like G2, where you can read reviews from companies similar to yours about actual implementation challenges and successes. For example, Drivetrain on G2 shows how mid-market companies have handled integrations with various ERP systems, giving you realistic expectations about timeline and complexity.

Request references from the vendor, specifically from companies in your size range and industry, and read published case studies. Mid-sized firms often face different integration challenges than large enterprises, so hearing from similar organizations about their experience with data mapping, user access controls, and ongoing maintenance will help you make a more informed decision.

Ask vendors to demonstrate exactly how their AI explains its predictions and recommendations to both technical and non-technical users. Request to see sample outputs that show not just what the AI concluded, but why it reached that conclusion. Can the system break down which data points influenced a forecast? Does it highlight when certain assumptions or external factors drove specific recommendations?

Probe their audit trail functionality by asking how the system documents AI-driven decisions over time. If an auditor questions a forecast or budget allocation six months later, can you trace back through the AI’s logic and data inputs? Request documentation showing how they handle model versioning.

Test their explainability with scenarios relevant to your business. For example, Drivetrain’s AI BvA feature doesn’t just flag budget variances; it explains the underlying drivers causing those variances in language that finance professionals can understand and act upon. Ask vendors to show similar examples where their AI provides actionable insights rather than just numerical outputs.

Finally, clarify whether non-technical finance staff can understand and validate the AI’s reasoning without involving IT teams. The best AI systems should empower your finance team to confidently explain automated decisions to stakeholders, auditors, and executives without requiring data science expertise to interpret the results.

The customization level depends on how closely your processes align with industry standards. Most leading AI finance platforms come pre-configured for common workflows like month-end close and budget planning, which work out of the box for many organizations. However, complex revenue models or unusual reporting requirements will need more configuration work.

Evaluate platform flexibility by asking vendors to demonstrate scenarios specific to your business. Can the system adapt to your chart of accounts or approval workflows? Look for drag-and-drop configuration tools rather than custom coding requirements.

Industry expertise significantly reduces customization needs. Vendors with deep sector experience often provide pre-built templates addressing common challenges in your industry. Check for active user communities in your vertical; peer organizations frequently share configuration best practices that save setup time. Request clear documentation about what's configurable versus what requires professional services or custom development.

Related AI tools for finance guides

We have even more information on AI tools for finance-related software and tools. Check them out.

.avif)

.gif)

.svg)