“The goal of forecasting is not to predict the future but to tell you what you need to know to take meaningful action in the present.”

— Paul Saffo

If you’re running a B2B or a SaaS business, you have to constantly make decisions without the luxury of clairvoyance, and uncertainty is an inevitable aspect of any B2B business. Financial forecasting software can help reduce the uncertainty in your business to help you make better, more informed decisions, mitigate risks, and optimize your financial performance for sustainable growth.

In this updated guide, we provide a review of 15 top financial forecasting software tools with a detailed comparison of their features, capabilities, pros, and cons to help you select the best one for your unique requirements.

To cover the broadest range of possible needs, we’ve broken these tools out into three categories based on the needs of the market sector they target with their solution:

- Enterprise, which is defined as 1000 employees and/or more than $100M ARR

- Mid-market businesses defined as 50-1000 employees, and/or $5-$100M ARR

- Small businesses, defined as 0-50 employees with greater than $5M ARR

We reviewed six solutions each for the enterprise and mid-market categories and another four for small businesses and startups. For each solution, you’ll find a summary of the key features related to financial forecasting the solution offers and some of the pros and cons you might want to consider as you evaluate your options.

We consulted a wide range of sources for this evaluation, including product documentation, third-party reviews and reports, security documentation and certifications, customer testimonials and user reviews, implementation case studies, and product documentation.

We’ve also included in a new discussion about how AI is being incorporated into the CFO and finance functions today. For this, we highlight five platforms that are leading the way forward with AI in how they are incorporating it into their platforms to enhance their financial reporting and other functions. This information will benefit CFOs and others working in corporate FP&A who want to leverage the power of AI to streamline their work and improve financial performance.

The best financial forecasting solutions for enterprises

To be competitive today, enterprises need financial forecasting software they can use to produce reliable forecasts despite the organizational and operational complexities inherent in the business, while still maintaining performance and compliance with enterprise-grade security.

Enterprises need predictive analytics and advanced modeling capabilities to fully leverage the wealth of data they possess. Features such as driver-based modeling allow enterprises to create more reliable forecasts based on important performance metrics, such as customer acquisition costs (CAC) and churn rates, as well as other metrics like the length of their sales cycles.

Sensitivity analysis helps enterprises tease out the often subtle effects of different variables in a complex forecasting model, while multi-scenario planning and analysis allows them to model and compare base, best, and worst case scenarios based on any number of variables. What-if scenarios allow enterprises to predict the impacts of business decisions, such as moving from tiered pricing to usage-based pricing.

Multi-entity management is a must-have for enterprises due to the complexity of their operations across all the regions where they do business, their subsidiaries, business units, product lines, and sales. Enterprises need automatic consolidation of financial forecasts that automatically adjusts the global forecast based on changes in individual forecasts from different areas of the business.

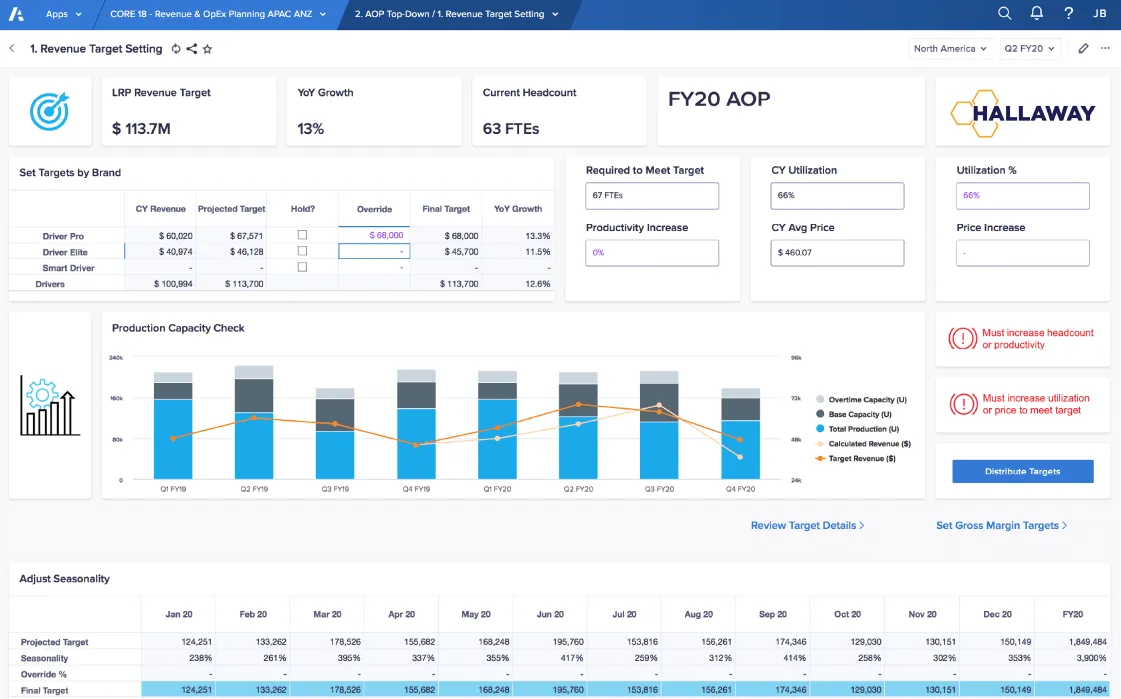

Reporting features are important to evaluate as well because forecasts are often shared with decision-makers that lack the technical expertise to interpret the complex models used to generate them. Customizable, dynamic dashboards (e.g., revenue reporting dashboards, sales reporting dashboards) that update forecasts in real-time makes forecasts easier to understand and far more actionable. Reporting templates, modeling templates, and other features that make a platform easier to use can free up valuable time for more strategic work, provided they are flexible and easy to customize and configure.

In this guide, we cover six financial forecasting solutions that offer these and other key features enterprise CFOs and their finance teams need to create reliable forecasts in a highly complex business environment at scale. They are Drivetrain, Anaplan, Workday Adaptive Planning, Oracle Cloud Enterprise Performance Management (EPM) Planning, Pigment, and SAP Business Planning.

Let’s take a look now at how these solutions stack up in terms of their enterprise-level financial forecasting features. The table below offers a quick look at that, followed by a more detailed analysis of each solution.

| Software/ Platform |  |  |  | %20%20logo.webp) |  |  |

|---|---|---|---|---|---|---|

| Price | $$ | $$$ | $$-$$$ | $$$ | $$$ | $$$ |

| Native integrations (excluding 3rd-party apps) | 800+ | 40-60 | 60+ | 85-100 | 30 | 90-100 |

| G2 ranking (out of a total score of 5.0) | 4.8 | 4.6 | 4.3 | 4.2 | 4.8 | 4.3 |

| Implemen-tation time (time to value) | 4-6 weeks | 5-7 months | 4-6 months | 8-10 months | 3-6 months | 8-10 months |

| Predictive forecasting & analytics | ||||||

| Multi-scenario planning & analysis | ||||||

| What-if scenarios | ||||||

| Driver-based modeling | ||||||

| Customi-zable forecasting models | ||||||

| Multi-entity manage-ment with automatic financial con-solidation | ||||||

| Forecast vs. actuals (FvA) analysis | ||||||

| Customi-zable modeling & reporting templates | ||||||

| Customi-zable dynamic dashboards | ||||||

| Enterprise-grade security features |

Our top pick for enterprises is Drivetrain. A more recent entry into the financial planning and analysis (FP&A) software market, Drivetrain offers a comprehensive solution equipped with a robust set of financial forecasting features and a powerful calculation engine built for scale with modern technologies.

With Drivetrain, implementation time is far faster than traditional enterprise solutions, with most enterprise customers able to start getting an ROI within weeks as opposed to months. Implementation also doesn’t require third-party support like most other enterprise solutions.

Drivetrain’s intuitive UI and ease of use combined with its advanced modeling capabilities makes it unique among its competitors, most of which require a steep learning curve that delays time to value. Finance and non-finance teams can quickly create multi-dimensional models using Drivetrain’s intuitive user interface and plain English formulas, which are 10 times faster than building models from scratch.

In Drivetrain, models can be fully and easily customized, enabling enterprises to create highly sophisticated financial forecasting models precisely tailored to their business needs. The platform’s driver-based modeling capabilities are particularly advanced and all models, whether created with Drivetrain’s flexible, pre-built modeling templates or built from scratch, leverage AI to automatically identify and analyze key factors impacting a forecast.

Drivetrain emerged in the enterprise market with strong multi-entity management capabilities and continues to rapidly build new ones to support enterprise-scale operations. For example, enterprises can easily manage foreign exchange rates (FX) and automate data consolidation from multiple ERPs in Drivetrain to create accurate, consolidated financial statements that financial forecasting requires.

The platform also provides comprehensive multi-dimensional scenario planning and what-if analysis capabilities enterprises need to accurately model complex business scenarios. The platform's real-time reporting and dynamic dashboard features provide immediate visibility into financial performance, and AI-driven insights that identify significant trends and anomalies in the underlying data.

Drivetrain provides enterprise-grade security to help global businesses maintain compliance and keep their data secure with features including detailed audit trails, fine-grained role-based access controls (RBAC), single sign-on (SSO), and encryption of data at rest and in transit. Drivetrain also has all the industry compliance certifications enterprises need to be confident in their compliance, including SOC 1 Type II, SOC 2 Type II, ISO 27001 and GDPR.

Powerful, scalable and yet simple to use, Drivetrain offers the full range of FP&A features finance teams need today, making it a complete financial planning and forecasting software.

800+ integrations to automatically consolidate data from core business systems

Rapid deployment with pre-built templates and unparalleled support

Customizable forecasting models with advanced AI capabilities to enhance accuracy

Best-in-class calculation engine with power to scale

Easy-to-use, self-service spreadsheet-inspired UI

Multi-scenario/What-if

ERP data consolidation and multi-currency support

Heavily focused on mid-market and enterprise businesses

Predictive forecasting capabilities

Multi-dimensional modeling capabilities

Comprehensive scenario modeling with real-time updates

Advanced driver-based modeling with AI integration

What-if analysis and sensitivity analysis with built-in sensitivity testing tools

Rapidly expanding multi-entity capabilities

Anaplan is a corporate performance management (CPM) software (aka enterprise performance management or EPM software). Anaplan is capable of most of the financial forecasting use cases that today’s enterprises require and incorporates connected planning features that enable cross-functional coordination across large organizations.

However, while the platform supports enterprise-wide planning processes, its biggest drawback is its inherent complexity. Implementation requires significant (and often dedicated) resources along with specialized expertise, both of which delay time to value and ultimately undermine the ROI. Similarly, while Anaplan offers an extensive template library to help enterprises with their financial forecasting, using them effectively may require specialized expertise or a steep learning curve.

Anaplan does provide predictive capabilities through standard statistical methods, along with scenario planning and what-if analysis tools to support financial forecasting and other modeling needs, and the platform includes driver-based modeling capabilities that support detailed business analysis.

As one of the most mature offerings on the market, Anaplan offers the multi-entity management features enterprises need today. As with all the enterprise platforms we reviewed, Anaplan provides the security features enterprises require, including all the relevant industry certifications.

Connected planning

Scalable (with upgrades)

Good customization capabilities

Limited number of native integrations

Long implementation times (usually 6 months or more)

Steep learning curve

Complex pricing model

Comprehensive driver-based modeling

Scenario planning capabilities including multi-scenarios and what-if analysis

Basic predictive capabilities (requires configuration)

Robust multi-entity management

Part of the larger Workday ecosystem, Workday Adaptive Planning is an enterprise performance management (EPM) tool that provides planning and forecasting capabilities that align well with standard enterprise requirements.

Workday Adaptive Planning provides the multi-entity management features necessary to support the more complex organizational structures typical of enterprise operations. It offers driver-based modeling capabilities and other types of modeling, along with scenario planning tools necessary for enterprise-level financial forecasting.

One of the drawbacks of Workday is that its formula builder uses a proprietary syntax, as opposed to the DAX-based Excel formulas most financial professionals are accustomed to, which imposes a steep learning curve to use it effectively.

The system also requires significant configuration, which leads to long implementation timeframes. Enterprises with existing investments in Workday may find implementation faster. However, even though the system functions effectively within the Workday ecosystem, some features may still require additional configuration or customization for specific requirements.

Interactive data visualizations

Offers custom integration support (for a fee)

Driver-based forecasting

Limited number of native integrations

Complex modeling UI with multiple tabs and configuration settings

Too many configurations lead to dependency on third-party systems integrators (SIs)

Long implementation times (often ~6 months to 1 year)

Multiple scenario planning

Multi-currency support available (requires configuration)

Customizable financial forecasting models (complex to build and may require third party support)

Oracle Cloud Enterprise Performance Management (EPM) Planning offers extensive financial forecasting well aligned with enterprise requirements.The platform provides multi-entity management features to support complex organizational structures typical of enterprise-level businesses. While it can generally handle large volumes of data needed for financial forecasting and financial modeling, some users have reported performance issues when dealing with large dimensional datasets.

The system includes advanced predictive capabilities through integrated analytics. Oracle Cloud EPM Planning also offers scenario planning capabilities with some limitations. For example, it requires significant setup for advanced scenarios and once built, can be complex to modify. The system’s predictive capabilities are good but they, too, require additional configuration. However, the platform maintains a comprehensive template library which can help mitigate the complexity to some degree.

A significant downside to Oracle’s Cloud EPM is the complexity of implementation, which is both time consuming and resource intensive and often requires six months or more. Third-party integrators can accelerate implementation but also add to the cost of the system, ultimately reducing its ROI.

Oracle Cloud EPM Planning integrates with Oracle Cloud Enterprise Resource Planning (ERP) system as well as many third-party solutions. However, connecting and configuring them further adds to implementation complexity and resource requirements of the system. They also require significant technical expertise to maintain. With this in mind, Oracle Cloud EPM Planning may be a good solution for enterprises already invested in Oracle ERP, as the ability to leverage those investments may help to offset the drawbacks of a lengthy implementation.

Robust features for enterprises with complex business models

Well suited for companies with existing investments in Oracle solutions

Advanced predictive capabilities

Integrations can be difficult to mange

Lengthy implementation times with heavy dependence on third-party systems integrators

Complex pricing model

Importing and exporting data manually is complicated

Performance can suffer with large or complex reports

Multi-entity scenario modeling and what-if analyses

Predictive forecasting

Multi-entity management

Pigment is one of the newer entrants into the enterprise market but with a level of complexity comparable to more mature systems. The platform offers a mix of capabilities well-suited to complex financial modeling and analysis while maintaining the flexibility needed to accommodate varying organizational requirements. However, the platform requires a lot of configuration, which results in longer implementation timeframes (2-3 months is typical).

Pigment supports enterprise-level financial forecasting with features including multi-dimensional analysis, multiple scenario comparisons. It also offers predictive forecasting capabilities, but they require manual validation of forecasting assumptions.

In comparison to the other solutions we reviewed, Pigment’s integration framework is much more limited, which may make it less suitable for enterprises requiring integrations for a large number of different business systems. The platform provides multi-entity management features enterprises need to do accurate financial forecasting. However, with relatively fewer integrations, such organizations may encounter limitations in terms of their ability to aggregate and prepare all the data needed for robust forecasting.

Modern, intuitive user interface with strong visualization tools

Flexible but somewhat limited multi-dimensional modeling

Driver-based forecasting and rolling forecast capabilities

Good performance with large datasets

Limited number of native integrations

Data model setup and system configuration leads to longer implementation times

Complex implementations require dedicated project team involvement

May require more technical expertise for advanced modeling

Scenario planning and what-if analysis

Multi-currency support and basic consolidation features

Driver-based forecasting capabilities

SAP Business Planning exists as part of the larger SAP ecosystem to provide enterprise-level financial planning and analysis capabilities. As with the other enterprise solutions covered in this guide, the platform provides multi-entity management features to accommodate complex organizational structures.

SAP’s scenario planning tools support financial forecasting but require additional configuration for advanced scenarios. While the platform offers good predictive capabilities, those also come with a complex setup. It offers strong capabilities for both multi-dimensional modeling capabilities and driver-based modeling, both of which are key to accurate financial forecasting.

While SAP offers a reasonably robust number of integrations, its primary focus appears to be on SAP environments, which makes it a good option to consider for SAP-centric organizations. While some features may require additional configuration or customization for specific requirements, various templates can help to offset some of that inherent complexity.

SAP Business Planning is highly customizable, but its complexity mirrors that of Anaplan and Oracle PBCS, requiring significant resources and expertise and similarly long implementation timeframes.

Reliable performance with large data volumes when properly configured

Templates to simplify financial modeling and forecasting

Extensive customization options

Lengthy implementation timeframe (6-12 months typical)

Complex user interface with steep learning curve

Additional modules often needed for full functionality

Advanced features requires complex configuration

Multi-entity consolidation capabilities

Driver-based forecasting

Predictive forecasting

Standard scenario planning features

The financial forecasting software for mid-market companies

As companies scale into mid-market, the complexity in their business grows. Mid-market businesses often have multiple revenue streams across different regions, which can make financial forecasting far more complex than it was when they were smaller. Another complicating factor is that while mid-market businesses typically have significant operational complexity, they often lack the resources for highly sophisticated features that come with enterprise financial forecasting software and people with the skills necessary to effectively leverage such an investment.

For accurate financial forecasting, mid-market businesses need solutions that offer a combination of financial planning and analytics capabilities and operational features to more fully understand how the complexity in their business impacts financial performance.

Departmental-level budgeting is very important as it allows for each department to provide key information necessary for accurate forecasting and collaboration features make it easier for department heads to provide their input and participate in the necessary reviews.

Basic scenario planning capabilities are also important for modeling base, best, and worst case scenarios related to different situations and planning decisions, while variance analysis capabilities help to identify significant departures from the original forecast. Mid-market companies also need a range of analytics capabilities, including historical trend analysis to better understand business cycles and seasonal patterns as well as historical growth rates. Basic predictive modeling is another analytics feature to look for if you’re a mid-market business.

Real-time KPI tracking allows businesses to keep an eye on the metrics that can impact a financial forecast while department-level reporting helps to track every department’s forecast accuracy and monitor the metrics relevant to each. It also improves the ability of mid-market companies to more quickly make precision adjustments as needed based on actual results.

Robust reporting features, including customizable dashboards and reporting templates (as long as they’re flexible and easy to use) can make reporting forecast results and other key information to stakeholders more effective. A broad set of native integrations covering all the core business systems (at minimum) is essential for ensuring those reports and forecasts are always up to date and will significantly reduce the time required and the human error that comes with manual data consolidation.

With all of these features in mind, let’s take a closer look now at the six mid-market financial forecasting solutions we cover in this guide: Drivetrain, Datarails, Vena, Mosaic, Abacum, and Cube. The table below offers a high-level summary and comparison of how each of these solutions stack up, followed by more detailed reviews.

| Software/ Platform |  |  |  |  |  |  |

|---|---|---|---|---|---|---|

| Price | $$ | $$ | $$$ | $$$ | $$ | $$ |

| Scalability | High | Moderate; Same limitations as MS Excel | High but requires extensive planning | HIgh | Moderate | Moderate |

| Integrations | 800+ | 70+ | 100+ | 30-45 | 40-60 | 40-60 |

| G2 ranking (out of a total score of 5.0) | 4.8 | 4.7 | 4.5 | 4.7 | 4.8 | 4.5 |

| Variance analysis | ||||||

| KPI and metrics tracking | ||||||

| Predictive forecasting | ||||||

| Scenario planning & analysis | ||||||

| What-if analysis | ||||||

| Customi-zable forecasting models | ||||||

| Automated real-time financial statements & reports | ||||||

| Department-level budgeting & reporting | ||||||

| Collabora-tion with access control | ||||||

| Dynamic dashboards |

Drivetrain is a comprehensive FP&A solution with a scalable, multi-dimensional modeling architecture that is powerful and intuitive, with a robust set of features and capabilities that can meet the different needs of enterprises and mid-market businesses equally well.

With Drivetrain’s intuitive user interface and plain English formulas, finance teams can create complex, multi-dimensional models in a fraction of time it would take to build them in other tools. Drivetrain’s growing template library provides modeling and forecasting templates with highly flexible customization capabilities, making it even easier for companies to create tailored forecasting solutions that align precisely with their business needs.

The platform also provides the ability to generate multiple scenarios like best-case, worst-case, base-case, and what-if analysis to help mid-market businesses better plan and prepare for various situations that can impact their financial forecasts. Drivetrain stands out in its ability to support financial forecasting with advanced AI-powered predictive forecasting and scenario modeling. Drivetrain’s variance analysis features also leverage AI enabling businesses to identify potential issues before they become significant problems.

Drivetrain offers the department-level budgeting capabilities that mid-market businesses need and robust, secure collaboration features to ensure that forecasts are well-informed from the bottom up. With 800+ integrations, Drivetrain automates data consolidation and helps keep forecasts up to date to facilitate rapid planning and re-forecasting when needed and adjusting effortlessly to the growth and complexity of the business.

Powerful yet simple to use, Drivetrain offers the full range of FP&A features finance teams need today, making it a complete planning and forecasting software.

AI-powered financial forecasting

Customizable forecasting models

800+ integrations with the ability to flexibly ingest data from any system

Best-in-class calculation engine with power to scale

Easy-to-use, spreadsheet-inspired UI

Robust collaboration features, with granular access controls

Automated, comprehensive KPI tracking with predictive capabilities

Real-time automated reporting with predictive elements

Heavily focused on mid-market and enterprise businesses

Predictive forecasting capabilities

Dynamic, AI-powered scenario planning and what-if analysis

Multi-dimensional modeling capabilities

Top-down and bottom up financial forecasting

Rolling budgets and forecasts

Real-time variance analysis

Rolling budgets and forecasts and predictive forecasting capabilities

While it requires Excel to function, Datarails is not an Excel plugin. Rather, it is a separate platform tightly integrated with Excel via a proprietary, built-in plugin. This approach allows users to keep their existing Excel workflows and models while providing additional features finance teams need for various types of FP&A, including financial forecasting.

The platform's primary strength is its ability to transform Excel-based financial processes into automated, controlled workflows while maintaining existing models and templates. However, organizations seeking advanced predictive capabilities or complex scenario modeling may find the Excel-based architecture somewhat limiting.

Datarails offers department-level budgeting features needed to support financial forecasting and dynamic dashboards to make reviewing forecasts easier for different departments. The platform also includes KPI and metrics tracking capabilities along with automated data consolidation features that provide for automated real-time reporting and variance analysis.

The platform falls short in terms of its predictive forecasting capabilities, which require manual setup and its scenario planning and what-if analysis tools that are functional but constrained by Excel-based limitations. However, its tight integration with Excel remains particularly appealing to organizations heavily invested in Excel-based processes as well as those that need a more robust financial forecasting solution but are not yet ready to replace their spreadsheets.

Familiar Excel interface

Comprehensive collaboration tools and departmental controls

Automated variance analysis

Robust template library

Lacks functionality needed for advanced modeling

Even simple models require 100s of formulas

Works only with Excel, not Google Sheets

Few customization options

Limited visualization capabilities, particularly for complex analyses

Basic forecasting capabilities

Basic predictive capabilities (requires additional configuration)

Scenario planning (though limited)

What-if analysis (requires manual updates)

KPI tracking with automated consolidation of metrics

Department-level budgeting

Vena is a Microsoft Excel add-in that was developed mainly for Microsoft 365, which can be particularly appealing to businesses already invested in the Microsoft ecosystem. As an Excel-compatible financial planning platform, it caters to mid-market businesses whose FP&A needs are more complex than they can easily manage with spreadsheets alone.

The platform incorporates variance analysis and KPI tracking features that maintain Excel workflows while adding automation and control elements. The platform also includes scenario planning and what-if analysis capabilities, both of which are key features to look for in a financial forecasting solution.

Vena leverages Excel's functionality to provide flexible modeling capabilities with a template library and customization capabilities that allow businesses to more easily tailor the forecasting models to specific needs. While the platform also offers predictive forecasting capabilities, certain predictive analytics features require additional configuration and integration with third-party tools is necessary for some of the more advanced features mid-market businesses may need.

Vena offers the department-level budgeting mid-market companies need for financial forecasting and collaboration features that allow different departments to provide key information for forecasts, along with dashboards and visualization options that make their forecast reviews easier.

Clean interface and easy-to-navigate menu options

Familiar Excel-based UI

Flexible forecasting capabilities

Extensive template library with good customization

Requires tech support for integrations (including setting up templates)

Long implementation times with expensive implementation and platform fees

Predictive forecasting requires third-party integrations

What-if analysis requires manual setup and maintenance

Department-level budgeting and forecasting

Performance metrics tracking

Scenario planning (with some limitations) and what-if analysis

Pre-built solutions for automation, including automated variance analysis

Mosaic provides some planning and modeling capabilities. However, it is more of a financial-BI tool than a comprehensive FP&A solution, with a number of integrations that help to consolidate and transform insights into accessible visuals. Mosaic was acquired by Hibob, a platform that serves the HR needs of mid-market businesses, in early 2025. We have included it in this guide to help current Mosaic customers evaluate suitable alternatives by comparing what they have in Mosaic now with the other options discussed here.

Businesses currently using Mosaic for financial forecasting have access to a suite of features that includes basic scenario planning tools and simple what-if analysis and variance analysis with some limitations,

It also offers predictive forecasting capabilities, however they are more basic compared to AI-driven solutions and require integrations for more advanced forecasting.

Department-level budgeting and collaboration features to support participation in the financial forecasting process, and basic version control with change tracking features make forecast review a little easier.

One of the most often cited drawbacks of Mosaic is its lack of flexibility. For example, while it provides financial modeling and forecasting templates, they offer very limited customization capabilities. And the platform’s highly structured approach also restricts robust scenario planning. With a growing library of highly customizable modeling and forecasting templates, CFOs and finance leaders looking for a more flexible framework that is powerful, yet easy to use will find it in Drivetrain.

Provides out of the box templates to get started quickly

Financial modeling capabilities

Robust scenarios modeling and what-if analysis

Offers real-time data updates (may be hampered by sync issues)

Model creation is rigid (highly inflexible) and highly templated

Limited number of integrations

Unintuitive and complex to use with multiple tabs, selections, and input fields to navigate

Longer implementation times due to configuration requirements

Limited access controls to support secure collaboration

Basic collaboration tools compared to competitors

Implementation requires significant configuration

Some advanced features need custom development

Multiple scenarios with simple what-if scenario planning

Automated KPI and metrics tracking

Automated variance analysis and tracking

Limited but functional predictive forecasting capabilities

Department-level budgeting

Abacum is a financial planning platform built for mid-market businesses. It offers department-level budgeting features that mid-market companies need for accurate financial forecasting and collaboration features that support the participation of different teams in the process. It also offers dashboards that provide basic visualization capabilities.

Abacum’s core strength appears to lie in its automated variance analysis and KPI tracking, both of which help mid-market businesses keep an eye on those that can impact their financial forecasts.

However, the platform is limited in some of the other key features needed for financial forecasting. For example, its predictive forecasting capabilities are very basic, and while it does offer customizable scenarios and what-if analysis, the platform’s ability to support complex scenarios is limited.

While the platform offers a template library, customization options are not as extensive as most competitors. While it does offer a user-friendly UI, Abacum’s reliance on SQL-like custom formulas present a steep learning curve for users new to the system.

Automated variance analysis

KPI tracking capabilities

Strong collaboration features

User-friendly interface for non-finance users

Limited advanced modeling and forecasting capabilities

Limited pre-built templates and models

Less robust in handling complex organizational structures

Limited scenario planning capabilities

Predictive capabilities require manual setup

Limited template library with few customization options

Department-level budgeting features

Variance analysis tools

Basic predictive capabilities

Basic scenario planning capabilities and what-if analysis

Next on our list is Cube, a spreadsheet-native business forecasting software designed to help businesses and finance teams streamline financial forecasting, workflow management, and budgeting operations. Cube uses multiple methods to integrate with Excel (add-in, API endpoints) to enhance Excel's native capabilities with additional features finance teams need for FP&A, including financial forecasting.

Cube provides good department-level budgeting features. However, its collaboration features are limited primarily to working within shared spreadsheets and lack more advanced functionality. The system also provides automated monitoring of KPIs and variance analysis to support financial forecasting and strong scenario planning and flexible modeling capabilities. What-if analysis is also available, but these capabilities are tied to manual updates and changes in data models.

The platform provides an extensive library of pre-built models and templates, that include customizable forecasting models. However, its predictive forecasting capabilities are rather basic and require configuration.

Using Cube effectively also requires more work than most of its competitors, which is due to a combination of a limited dimensional structure, which often requires complex ETLs to restructure data to fit into Cube’s system. Integrations can help here, however they too are limited in comparison to other mid-market solutions covered in this guide. Users have also reported performance issues with the system taking more than an hour to refresh larger data sets.

No custom formulas are needed

UI is simple and familiar to most users (in Excel format)

Strong Excel integration maintaining familiar workflows

Comprehensive library of pre-built models and templates

Complex ETLs, owing to a limited dimensional structure

Data must be restructured to fit into Cube’s system

Limited drill-down capabilities (summary-level only)

Multi-dimensional analysis capabilities are limited to 8 top-line dimensions

Data refreshes can be slow with large data sync commonly taking more than an hour

Limited number of integrations

KPI tracking

Basic variance analysis

Department-level budgeting with collaboration tools

Scenario modeling including what-if analysis

The best forecasting tools for small businesses and startups

For small businesses and startups, financial forecasting software needs to provide basic forecasting capabilities and core reporting features that are robust enough to provide the answers small businesses need without requiring a high level of technical financial expertise that many small businesses lack. Solutions need to be cost-effective, too, as small businesses don’t have the same resources as their mid-market counterparts.

Key forecasting features suitable for small businesses and startups to look for include the ability to easily create revenue projections and predict cash flow, ideally with templates to start with.

The ability to create a budget and to categorize and track expenses, either directly or through integration with a company’s accounting software provides a foundation for financial forecasting. However, in order to fully understand how well the business is controlling its spending—a key requirement for accurate forecasting—basic budget vs. actuals (BvA) and variance analysis capabilities are also needed. Basic scenario planning and what-if analysis features can help small companies better prepare for different potential situations that can impact their business, provided they’re easy to use.

Integrations with all the common systems small businesses use is also very important in terms of fully leveraging the investment in a financial forecasting software. Integrating with popular small business accounting software (e.g. Quickbooks, Xero, or any other the business is using) should be considered non-negotiable. But, that’s not all. Look for integrations with all the other systems the business uses—any system with data that can impact the company’s finances is important for accurate forecasting.

Core reporting features that a small business needs include the ability to run or automate simple variance reports and create basic financial statements (either directly or through integration). Look for the ability to easily create basic financial dashboards to communicate this and other information visually to make it easy for everyone in the business to understand.

The overall ease of use of a solution cannot be overstated. Small businesses don’t have the time or the deep financial expertise needed for a highly sophisticated tool that requires extensive training or specialized skills. They need the ability to get up to speed fast with a solution that’s easy to configure, offers plenty of templates and wizards, and an intuitive user interface.

We’ve reviewed four financial forecasting solutions well suited to the needs of small businesses and startups. They are Causal, Budgyt, Fathom, and Finmark. In the table below, you’ll find a comparison in terms of the core features needed for financial forecasting and other factors important to small businesses. More detailed reviews of each can be found following the table.

| Software/ Platform |  |  |  | |

|---|---|---|---|---|

| Price | $ | $$ | $$ | $ |

| Scalability | Moderate | Moderate | Moderate | High |

| Native integrations | 15 | 10 | 12 | 10 |

| G2 ranking (out of a total score of 5.0) | 4.6 | 4.8 | 4.5 | 4.6 |

| Basic forecasting templates | ||||

| Expense categorization & tracking | ||||

| Simple budget creation | ||||

| Basic budget vs. actuals | ||||

| Basic scenario planning & what-if analysis | ||||

| Visual financial dashboards | ||||

| Template-based reporting | ||||

| Ease of use | ||||

| Customer support & resources |

Causal is a financial modeling tool designed to streamline cash flow forecasting and budgeting for businesses. Users can create projections based on a range of variables and scenarios, making it accessible even for those with limited financial expertise.

Causal was acquired by Lucanet In October 2024. Lucanet is a financial performance management software that serves primarily mid-market companies. While one of Causal’s co-founders, Lukas Kobis, has said that Causal will be shifting its focus to mid-market businesses in the future, for now, it still appears to be available to small businesses looking for an affordable, straightforward solution for their financial forecasting needs.

Causal focuses on providing accessible financial forecasting tools for small businesses, with an implementation process designed for quick setup.

While the platform has the ability to handle complex calculations without requiring advanced financial expertise, it does come with a steeper learning curve, particularly for users unfamiliar with financial modeling. However, pre-built templates provide a starting point for financial modeling and forecasting and allow for extensive customization. The platform also incorporates visual elements into its forecasting capabilities, enabling users to create and adjust models through an interactive interface.

Despite these limitations, Causal remains appealing to startups and small businesses without dedicated finance teams as it is able to transform complex financial modeling into easy-to-understand visual forecasts with a modern UI and interactive dashboards.

Clear visual representation of financial data

Integrated expense tracking for more accurate forecasts

Good customer support and extensive learning resources

Integrates well with various financial management tools small businesses use

Quick implementation and minimal setup requirements

Advanced analytical features are lacking

Advanced features have steeper learning curve

Limited expense categorization options

Intuitive forecasting templates (though limited in terms of their customization)

Scenario planning and what-if analyses

Financial modeling and forecasting templates

While Budgyt provides some financial forecasting capabilities, its primary focus is on expense tracking and budget management with features for categorizing and monitoring expenses and supporting collaborative budget creation.

Budgyt offers a practical solution for small businesses looking for a more structured approach to financial planning that spreadsheet-based budgeting can provide. Budgyt provides an easy transition for users accustomed to working with Excel while eliminating many of the limitations inherent in spreadsheets. Implementation requires some initial setup time to configure the system according to specific needs.

As its name suggests, Budgyt’s features are strongly centered around budgeting rather than financial forecasting. The platform's budget versus actuals tracking enables regular performance monitoring which, combined with variance analysis tools, can inform financial forecasting. The system provides basic forecasting and scenario planning capabilities, however they are more basic compared to some of its competitors.

Comprehensive budgeting tools with good flexibility

Strong expense categorization and tracking capabilities

Detailed variance reporting with good drill-down options

User-friendly interface requires minimal training

Extensive template library

Limited template options requiring manual setup

Rationale: Basic scenario capabilities with limited flexibility

Basic visualization options with limited customization

Moderate setup time with some configuration needed

Fewer integration options compared to competitors

Basic dashboard visualizations and reporting

Basic (but limited) forecasting capabilities

Basic (but limited) scenario planning capabilities

Variance analysis, including budget vs. actuals

Detailed expense tracking

Fathom is an all-in-one financial reporting, analysis, and financial forecasting tool for small businesses. The platform connects natively with common tools that small businesses use, including QuickBooks and Xero, enabling real-time access to the financial data needed for financial forecasting.

Fathom combines financial analysis tools with reporting capabilities, however, its primary focus appears to be on financial reporting. Fathom offers a template library that includes templates to provide a starting point for financial forecasting and some other forecasting tools, including collaboration tools to support participation in the forecasting process. The system also enables basic scenario planning. Overall however, Fathom’s forecasting capabilities overall are basic compared to its competitors.

Strong financial analysis capabilities

Customizable forecasting templates

Highly customizable expense categorization

Advanced variance analysis with trend identification

Intuitive, easy-to-use UI and short learning curve

Customizable dashboards and report templates

Scenario tools lack advanced modeling features

More focused on reporting than forward-looking analysis

Limited planning and forecasting capabilities

Some users have reported performance issues when managing large data sets

Accounting software integration and data consolidation

Basic financial forecasting

Basic scenario analysis features

Comprehensive tracking and analysis of budget vs actuals

Finmark is a user-friendly financial planning tool that focuses on making budgeting and financial forecasting simpler for small businesses with collaboration features that facilitate broader participation in the process.

The platform includes features for basic budget creation and scenario planning, enabling users to model different business situations. It also offers well-developed capabilities for what-if scenario modeling. However, these features impose a steeper learning curve requiring more financial knowledge than some of the other alternatives featured in this guide. Finmark also includes basic variance analysis capabilities for tracking performance against plans, which helps small businesses identify problems early,

Setup is relatively quick, though some configuration may be required for specific needs. Finmark integrates with popular accounting systems small businesses use including QuickBooks and Xero. While its expense categorization and reporting features are a bit more basic, Finmark offers a user-friendly UI, intuitive templates, and good visualization options that make it an appealing option for small businesses.

Intuitive, user-friendly design

Fast, effective implementation

Real-time expense tracking

Integration options more limited than competitors

Basic comparison tools with limited analysis options

Simple variance calculations without deep insights

Financial forecasting templates

Multiple scenario modeling and what-if analysis

Variance analysis

How to choose the right financial forecasting software for your business

What is a financial forecasting software?

Financial forecasting tools help businesses analyze past business performance, current business trends, and other relevant factors to make accurate financial forecasts. With financial forecasting software, CFOs can model future outcomes quickly and make more informed decisions on how to improve it.

What are the different types of financial planning tools in SaaS?

Financial forecasting methods typically involve the use of large, complex, and interconnected offline spreadsheets. FP&A teams (more than any other function) have traditionally relied heavily on Microsoft Excel or Google Sheets for this purpose.

However, large and complex spreadsheets are a challenge even for people using them in everyday routines. They require a very long cycle for consolidation, and manually manipulating data in spreadsheets offers little time for modeling, simulations, and analysis—where the talent of finance managers is most needed.

The intense back-and-forth involved in verifying the data in spreadsheets—checking the version of each one to make sure it’s the most current and reviewing all the formulas—in addition to the time required to consolidate all the changes from each spreadsheet owner makes for a pretty a brutal workload for everyone involved.

Suffice to say that while spreadsheets are an excellent tool for very small startups with simple business models, they just are not designed to support businesses that need to scale.

“I think the key is for executives to be able to see the impact of changes to variables in real time so they can get an understanding of the risks and opportunities around the range of potential inputs.”

— Paul Barnhurst, The FP&A Guy

If you’re ready to trade in your spreadsheets for a purpose-built solution for financial forecasting, take a look at the table below to get a better understanding of how each of the 15 tools we’ve covered here stack up in terms of the degree to which they rely on spreadsheets.

Source: Adapted from FP&A software classifications developed by Paul Barnhurst (The FP&A Guy).

| Software/ Platform | Market Sector | Web application that replaces spreadsheets | Web application that integrates with spreadsheets | Application that uses spreadsheets for calculations | Add-in for spreadsheet applications |

|---|---|---|---|---|---|

| Drivetrain | Enterprise & Mid-market | ||||

| Anaplan | Enterprise | ||||

| Workday Adaptive Planning | Enterprise | ||||

| Oracle BPCS | Enterprise | ||||

| Pigment | Enterprise | ||||

| SAP Business Planning | Enterprise | ||||

| Datarails | Mid-market | ||||

| Vena | Mid-market | ||||

| Mosaic | Mid-market | ||||

| Abacum | Mid-market | ||||

| Cube | Mid-market | ||||

| Causal | Startups & Small business | ||||

| Budgyt | Startups & Small business | ||||

| Fathom | Startups & Small business | ||||

| Finmark | Startups & Small business |

Real-world use cases for financial forecasting software like Drivetrain

Financial forecasting is a complex process, especially for fast growing businesses. While spreadsheets will work for a while, eventually every business will outgrow the limitations inherent in spreadsheets. Whether they feel this first as a process growing more and more painful over time, either in terms of its complexity or just the sheer amount of manual work required, at some point every finance professional will begin to look for an alternative.

For all but the smallest companies, it’s pretty clear that FP&A teams need to abandon spreadsheets and move to robust financial forecasting software like Drivetrain to forecast at the speed and dimensionality of their business. When you make this kind of an investment, you’ll begin to see the returns immediately.

Fortunately, there’s a lot of them out there now. But, they’re not all created equal.

This is something that Quantum Metric discovered the hard way. As a fast-growing digital analytics platform, Quantum Metric was beginning to feel the pain of using spreadsheets for FP&A. As the company scaled, its financial model had simply become too large and complex for Excel to handle, causing it to crash pretty regularly.

So, Quantum Metric went looking for a new solution and invested in one they thought would solve the problem. The vendor promised it would allow them to create a more robust, detailed model for their financial planning and forecasting. However, they quickly discovered the platform was very rigid, and the configurations necessary to build financial models were extremely complex.

“It was a nightmare. The implementation team was a third party, and they weren’t invested in the product. It was a tool that was for everyone. So, they were trying to build us the same types of models that they were also building for a construction company.”

– Andrew DeFanti, FP&A Manager, Quantum Metric

Ultimately, the company had to continue maintaining its original Excel model for more than a year and a half while at the same time, struggling to implement the solution it had invested in. That’s when they switched to Drivetrain.

Hearing about the company’s experience with the other platform, Drivetrain’s customer success team immediately got to work recreating the company’s financial model on the Drivetrain platform. Before long, Quantum Metric once again had a robust and highly detailed financial model. But now it’s in Drivetrain.

With all its data automatically consolidated and accessible in real time on the Drivetrain platform, Quantum Metric can update its financial model in 20 seconds, easily create a new forecast every quarter.

The moral of the story here is that it can be pretty tough to find the perfect software solution. As one of the most comprehensive FP&A solutions on the market today, Drivetrain comes pretty close. And with the kind of support customers receive during implementation and on a day-to-day basis, Drivetrain stacks up to be a safe and sound investment—one that will significantly accelerate the time to value in your business.

7 key capabilities businesses of any size should look for in a financial forecasting software

While the specific features and capabilities companies need is in large part, determined by the size and complexity of the business, there are always those must-haves—a set of minimum features that all businesses should be looking for in a financial forecasting software. We’ve listed these below.

1. Native Integrations

Integrations are an integral feature of any financial planning software. In financial forecasting, you must connect to multiple data sources, such as ERP, accounting, invoicing, HRIS, CRM, and more, to extract historical data and data about current and future market demands.

The capability to connect to each source system is essential for the organization to base decisions on everything known both inside and outside of the organization. Your chosen forecasting tool should allow you to centralize your master data and transaction data from all source systems that contain the data you need.

Specific features to look for:

- Native integrations with popular ERPs

- Native integrations with top CRM, HRIM, Billing, and BI tools

- Integration with Excel and Google Sheets

- Excel and/or CSV upload and download

2. Predictive forecasting

State-of-the-art predictive forecasting capabilities are a must-have in your forecasting platform. The forecasting features of any tool you’re considering should provide real-time access to historical data and support multi-dimensional forecasting methods as these are critical to helping businesses generate more accurate forecasts of future revenues, expenses, and cash flows. Moreover, they enable you to make more data-driven decisions regarding resource allocations in the short term as well as long-term strategic planning.

Specific features to look for:

- The ability to create rolling forecasts

- Pre-configured forecasting methods including driver-based forecasting

3. Multiple scenarios & what-if analysis

Scenario planning is a crucial aspect of forecasting as it helps you to prepare for multiple potential future outcomes. It enables you to hedge against the worst-case scenarios by providing predictions for uncertain events. Your financial forecasting tool should, at minimum, allow you to build and test multiple scenarios and forecast for period-related fluctuations, such as seasonality and intermittent demand.

Specific features to look for:

- Sensitivity analysis

- What-if analysis

- Unlimited scenarios

4. Multi-dimensional modeling

A financial forecast requires you to factor in a lot of moving parts and several variables that go beyond financial figures. To achieve an accurate forecast, you need financial modeling software that allows you to customize inputs and calculations, make manual adjustments, support flexibility in creating budgets (see zero-based budgeting software) and test various scenarios.

You should also be able to create multi-dimensional financial models, reports, and dashboards—all at the speed and dimensionality your business operations require.

Specific features to look for:

- Automated data consolidation with real-time connections to multiple sources

- In-memory multi-dimensional calculation engine

- Unlimited planning window for long-range planning

- Customizable model templates with the ability to incorporate a wide range of variables

5. Automated reporting and dynamic dashboards

The best financial forecasting software should be able to provide you with the reports you need on the fly. Additionally, it should be able to display forecasts in interactive charts, graphs, dashboards, and reports. This is key to giving your stakeholders the ability to engage more deeply with the data they’re looking at – to explore it and get answers to their questions.

Dashboards, of course, offer visual clarity and communicate far more effectively than presenting results in a table packed with numbers. So, look for a solution that offers dynamic dashboards that allow you to create powerful narratives behind the numbers.

Specific features to look for:

- Ability to drill down to transaction-level data

- Ability to view your data in any dimension (e.g. by region, department, product, etc.)

- Global- and report-level filters

- Automated 3-way financial statements

- Text callouts and notes in dashboards

- Customizable reporting templates

6. Collaboration with role-based access control

Financial forecasting is an iterative process requiring collaboration and regular evaluation by various departments. Everyone involved should be able to operate, communicate and manage everything through a single platform—removing the need for sequential operations.

Collaborative capabilities should provide different teams with relevant alerts and notifications when there are changes in their data or any exceptions. This ensures users never miss a critical update.

Another thing to keep in mind is how different users can collaborate. While some vendors offer commenting threads within the application, granular role-based access is necessary to keep up with all communication and ensure messages are seen only by the people for whom they were intended.

Specific features to look for:

- Threaded comments

- Fine-grained role-based access control

- Slack notifications (an approved Slack app)

7. Onboarding, training, and customer success

Longer implementation times and delayed onboardings slow down the time to value and can significantly impact the ROI. Your chosen financial forecasting software should offer features that help all departments learn and adopt the software quickly so they can leverage it to its full potential.

Ideally, the solution you choose would have an in-house implementation team, which will always help get you up and running faster. In contrast, third-party implementation almost always introduces delays, which not only erodes your ROI but can also create frustration among your users, hampering adoption. Other features to look out for include interactive walkthroughs, self-service support, and quick customer service.

Specific features to look for:

- Reasonable implementation times given the complexity of your business and use case

- Self-service management and administration

- Plenty of resources, including solid documentation, tutorials, and interactive walkthroughs

- Dedicated customer support and success teams

Drivetrain vs. the field: Why Drivetrain is the best financial forecasting software

The solutions we cover here come from a combination of progressive, innovative software startups and prominent, traditional enterprise software vendors. They all differ in their approach to providing financial forecasting and other FP&A capabilities B2B and SaaS companies need today. However, Drivetrain stands out as a hybrid solution that combines the best of both worlds.

Drivetrain is purpose-built for strategic finance, offering all the features enterprise and mid-market SaaS and B2B businesses need to fully support their FP&A now and in the future.

For businesses that need to scale quickly, Drivetrain offers the agility and ease of use of simple software while also providing the high-end capabilities of an enterprise solution.

Of course, performance is a key concern when choosing a solution that will scale with your business. You don’t need to worry about that with Drivetrain, though. With a powerful calculation engine under the hood, Drivetrain is capable of handling increasing workloads with ease.

The platform itself is also very easy to use. Ideal for both FP&A and non-finance teams, Drivetrain’s spreadsheet-inspired UI combined with plain-English formulas makes your data business-ready and accessible to all stakeholders so they can directly perform the different types of analysis they need to quickly reveal new insights.

With Drivetrain, you can be confident that you are getting the best financial projections software to help you streamline your financial processes, make better decisions, and achieve your business objectives—faster.

FAQ

Our review of the many financial forecasting tools revealed that what is the “best” software really depends on the size of your business. In this context, business size can be considered something of a proxy for the level of complexity in your business, which in turn, drives the types of features and capabilities you’re likely to need for FP&A. Here are top contenders we identified as offering the most robust solutions for each category we reviewed:

Enterprise with 1000+ employees and/or more than $100M ARR

- Drivetrain

- Anaplan

- Workday Adaptive Planning

- Oracle Planning & Budgeting Cloud (EPBC)

- Pigment

- SAP Business Planning

Mid-market businesses with 50-1000 employees and/or $5-$100M ARR

- Drivetrain

- Datarails

- Vena

- Mosaic

- Abacum

- Cube

Small businesses & startups with 0-50 employees and greater than $5M ARR

- Causal

- Budgyt

- Fathom

- Finmark

There are essentially four main steps to creating a financial forecast.

- Gather your past financial statements

- Choose a method for your financial forecast

- Analyze financial data

- Create financial statements

While you’re looking for the best financial forecasting software solution for your business, you can get started quickly with a good template for financial forecasting , which will streamline the process for you. Or you can schedule a demo of Drivetrain to see how to better predict your company’s future performance today.

AI is poised to revolutionize data analysis and predictive capabilities in FP&A software for more accurate planning and forecasting. Drive AI was built to provide enhanced user experiences through more intuitive interfaces and interactive dashboards – all powered by AI insights.

Here’s a list of the tools currently available in Drive AI, along with some examples of what you can do with them:

- AI Model Generation: Generate baseline models from your ERP, CRM, HRIS data in one click.

- AI Transforms: Transform your data in seconds with simple English prompts.

- AI Alerts: Receive automated data anomaly alerts via slack, email, product inbox for any issues in the data pipeline.

- AI Analyst: Explore your data more deeply with the AI Analyst. Get responses to your questions about your data and metrics instantly.

As the use of AI in FP&A continues to evolve, Drivetrain will continue to lead the way. We continue to explore new and innovative ways to incorporate AI into the platform to further empower CFOs and finance teams that use it.

To see how Drive AI stacks up alongside other leading solutions, explore our guide on the best AI financial forecasting tools finance teams are using today.

.svg)