Revenue planning provides the data and insights CFOs need to make data-driven decisions about what their sales targets should be and how to meet them faster. The right revenue planning software can help you create more reliable sales forecasts by identifying key drivers and bottlenecks in your pipeline and evaluating the impacts of different strategies for optimizing revenue generation, costs, and profit. It can also help you become more agile in your decision-making, allowing you to keep your finger on the pulse of your pipeline and quickly reforecast opportunities when needed to meet your targets.

CFOs have a lot of options today when it comes to choosing revenue forecasting software for their business. If you’re trying to figure out what revenue forecasting solutions to consider, you’re in the right place. Here, we provide a blow-by-blow comparison of six top software solutions for revenue software along with a comprehensive guide to the features and other factors you should consider when looking for a solution to drive predictable and more profitable growth in your business.

The best revenue software compared

Accurate and reliable forecasting is the foundation of a revenue forecasting platform. However, your chosen software should go beyond that–it should actively support and enhance your revenue generation efforts. We have shortlisted the best revenue tools with their features, pros, and cons to simplify the selection process.

Below is a comparative chart based on their functions and capabilities, followed by a detailed description.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| Price | $$ | $$ | $$ | $$ | $$-$$$ | $$$ |

| Best for | SMB to Mid-Market | Mid-Market | SMB to Mid-Market | Mid-Market | Mid-Market | Enterprise |

| Type of FP&A solution | 3rd Generation | 2nd Generation | 3rd Generation | 2rd Generation | 2nd Generation | 2nd Generation |

| Scalability | High | High but requires extensive planning | Moderate; Same limitations as Google Sheets | High | Scalable but requires continual adjustments | Scalable with upgrades |

| Native Integrations | 200+ OOTB integrations | Few native integrations | 13 OOTB integrations | 100+ OOTB integrations | 7 OOTB integrations | 10 OOTB integrations |

| Multi-dimensional revenue modeling | ||||||

| Dynamic Dashboards | ||||||

| Security & Compliance | ||||||

| Onboarding, Training & Customer Success |

Drivetrain

Drivetrain is a powerful and intuitive platform and our #1 choice for revenue forecasting software. It is an all-in-one FP&A solution designed for startups and medium-sized companies. With its range of forecasting capabilities, Drivetrain provides revenue teams with the granular insights required to drive your business forward.

The platform considers current trends and factors specific to your business, including churn rate, and linear or exponential growth, to aid CFOs and finance experts in strategic decision-making.

Drivetrain offers faster time to value and is competitively priced. Powerful yet simple to use, Drivetrain can help you drive revenue predictably across new businesses, renewals, and expansions. With over 200 integrations, you get quicker time to value with no high-cost implementation fees and a swift onboarding process.

$$

Small and Mid-market

Purpose-built for B2B and SaaS companies

Multi-currency support

200+ popular integrations

Advanced collaboration and workflow management features

Automated reporting with interactive dashboards

User-friendly self-service interface

Extensive customization options

Not well suited for enterprise-scale companies

Multidimensional revenue modeling

Sales quota and territory planning

Sales capacity planning

Incentive compensation management

Territory planning

Scenario planning and what-if analysis

Drilldown and audit trail

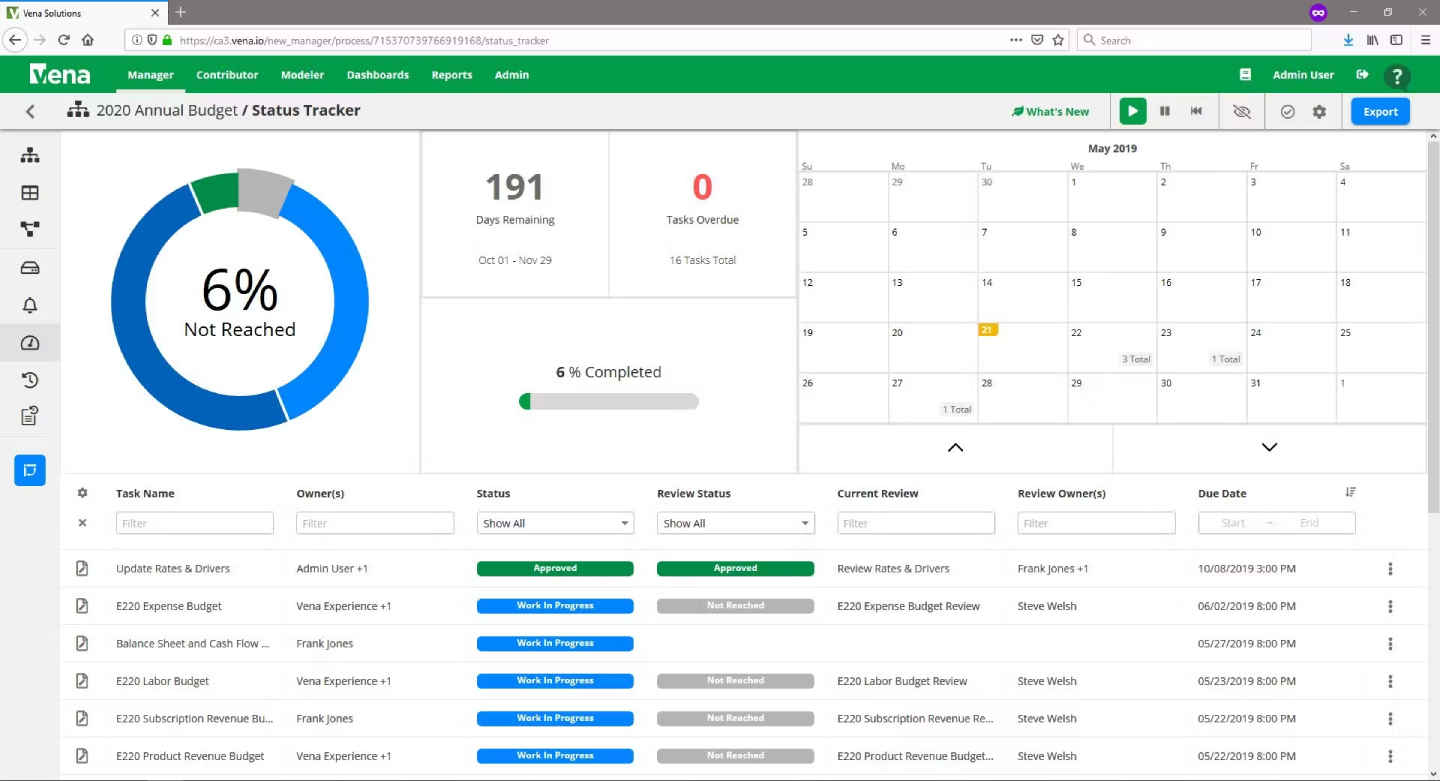

With a familiar Excel interface, Vena is a Microsoft Excel add-in that promises to offer useful insights integral to business strategy. Its simple interface allows users to operate in a desktop or browser-based version of Excel (not Google Sheets) and take advantage of its strengths, including what-if analysis.

$$

Mid-market

Offers templates library for forecasting activities

Sophisticated financial modeling features

Native integration with Excel

Does not integrate with Google Sheets

Offers only limited functionality with Mac

Does not support real-time data refresh for every information stream

Limited access controls/permissions

Steep learning curve

Revenue and expense planning and reporting

Excel powered what-if analysis and scenario planning

Activity dashboard

Activity tracking

Ad hoc reporting

Like Vena, Cube is a revenue forecasting software built for people comfortable with spreadsheets. While it does require some basic knowledge to make the most of the platform, it achieves its goal by simplifying the process of building templates and providing an intuitive interface. With Cube, you can dig into the underlying data table and update dimensions or mappings as needed. Additionally, the data is easy to export for analysis on external platforms.

$$

Small to Mid-market

Seamless integrations with spreadsheets (Google Sheets).

Automates menial tasks

Multi-currency support

Expensive compared to rivals

Lack of flexibility in Excel reporting

ERP integration is not included in the base plan

Multidimensional analysis capabilities are limited to 8 top-line dimensions

Drill-down capabilities are limited to the summary-level

Automated data consolidation

Multi-scenario analysis

Customizable dashboards

Native Google Sheets integration

Centralized formulas and KPIs

Planful is a financial close, consolidation, and financial planning & analysis cloud software. Suited for mid-market companies, this second generation platform helps FP&A teams make more confident decisions and reduce reliance on manual processes.

$$

Mid-market

Easily export model information from Planful to Excel

Beautiful UI that enables both regular and infrequent users

Good customer service for solving basic issues

Slow data retrieval and manipulation

Difficult to set up report templates

User setup is confusing with complex configurations resulting in longer time-to-value

Steep learning curve

Weak management of custom data tables

Revenue forecasting via Structured Planning module

Rolling forecast

Workforce planning

Cash flow forecasting

Workday Adaptive Planning (formerly Adaptive Insights) is an enterprise performance management (EPM) tool including revenue planning features. Designed for large enterprises and midsized companies that are seeking strong capabilities outside of revenue forecasting and FP&A, making it a great choice for businesses looking to transform their financial processes companywide.

$$-$$$

Mid-market

Flexibility to create your own planning models

New forecasts can be set up in minutes once you convert your entire Excel process to Adaptive

Ability to create customized reports

No upgrades to new planning sheet types in the past few years

Creating separate sheets for all prepaid expenses is cumbersome

Exporting to Excel or PDF format is time-consuming and difficult

Offers only 7 pre-configured data connectors (adapters)

Longer implementation times (~6 months to more than 1 year) with heavy dependence on third-party system integrators

Not ideal for teams wanting to experiment with revenue or expense structures

Annual Planning

Sales capacity and headcount planning

Top-down sales target setting

Collaborative financial modeling

Anaplan is a business planning platform that allows you to consolidate and analyze data. Although it's a second-generation FP&A tool, it has most of the revenue planning capabilities suiting enterprise-level businesses. You can forecast sales by various dimensions such as geography, product line, or account with any other level of granularity.

$$$

Enterprise

Highly scalable calculation engine

Real-time collaboration features

Multidimensional analysis capabilities

Long implementation times (Usually 6 months minimum)

Steep learning curve

Some users have reported that getting technical support is challenging

Pricing can significantly increase as the tier and application complexity increase

Project planning

Workforce planning

Budgeting, planning and forecasting

Commission calculation

Demand planning

Drivetrain vs. the field: Why Drivetrain is the best revenue planning solution

Now that we have discussed the nitty-gritty of these platforms, narrowing down choices would have been easier. Whichever tool you choose, ensuring it fits seamlessly with your existing workflows and enhances the team’s ability to provide strategic, data-driven advice is crucial.

Your decision could be the difference between a team that merely reports numbers and a strategic partner driving your organization’s growth and profitability.

With a 4.9 out of 5 rating on G2, Drivetrain emerges as a front-runner in both short-term and long-range financial planning and revenue forecasting capabilities. Its highly sophisticated and scalable calculation engine, spreadsheet-inspired UI, and multiple forecasting templates make it a go-to choice for small and mid-sized businesses, startups, and growing businesses.

With Drivetrain, you get complete visibility into historical performance, pipeline revenue projections, and future quarter projections—with extreme accuracy.

Answer all the revenue-critical questions and pull the right levers with this powerful yet simple revenue planning solution.

See how Drivetrain can improve revenue planning to drive precision

How to choose the right revenue software for your business

What is revenue planning software?

A revenue planning software estimates the income a business will likely generate in different areas over time. The software empowers FP&A and revenue operations (RevOps) teams to predict future revenue. Typically, a revenue platform analyzes past business performance, current trends, and other relevant factors to produce accurate revenue projections.

Top 6 benefits of revenue forecasting tools

Effective revenue forecasting is a cornerstone for businesses. You need to understand unique revenue streams—subscription, usage, and add-ons—and how internal and external changes influence your revenue. Revenue software makes it easier to have this visibility and helps you make well-informed decisions regarding pricing, sales strategies, and resource allocation.

1. Automated data consolidation and data validation

Revenue planning requires combining the financial and operational data from different departments, divisions, functions, and subsidiaries within an organization. This information, coming from disparate sources, might not be accurate or standardized. A comprehensive revenue software not only consolidates diverse financial and business reports but also ensures the accuracy and quality of data. All information in a single snapshot gives C-Suite, RevOps, sales, finance, and other departmental stakeholders valuable insight into the organization's overall business health.

2. Reforecast as often as you need

With the right revenue software, you can test your revenue models, and forecast as often as your business demands and in a shorter time. This further enables you to constantly monitor their effect on revenue expansion, churn, and customer acquisitions.

Drivetrain, for example, helped Mindtickle do weekly re-forecasting exercises using real-time actuals from their business systems and by using complex triangulation models.

Drivetrain clearly shows us how the conditions are changing so that we can adjust our forecasts. Our model is based on trailing data that goes back up to four quarters. So, as average deal cycle times, win rates, and deal sizes change, we are able to recalibrate quickly and adjust our forecasts and guidance for the quarters ahead.

— Aman Bafna, Mindtickle

3. Increase the accuracy of revenue plans, forecasts, and models

As many as 68% of companies miss their forecast by less than 10%. Revenue planning software helps you tackle this challenge by providing accurate pipeline projections. It leverages historical data, trend analysis, and predictive modeling techniques to generate accurate revenue projections. It enables users to quickly and easily update multidimensional revenue models (as it’s easy to explore the assumptions and dependencies in the model) to prevent errors.

4. Resource allocation optimization

Accurate revenue forecasts form the basis of budgeting and planning. When you can predict future income, you can more effectively allocate resources by aligning investments with projected revenue streams. By identifying high and low revenue generation periods, FP&A teams can do sales capacity planning more effectively and avoid over or under-staffing.

5. More value-added analysis and less manual, tedious, error-prone, repetitive number crunching

Utilizing revenue planning software means spending more time doing value-added activities and less time on managing and interpreting data. With the help of revenue software, CFOs and finance leaders can put the current, past, and predicted financial results in perspective and quickly set quotas. Less time spent on target crunching drives faster alignment among reps, managers, teams, and the organization.

6. Efficient sales performance management

Revenue software allows you to monitor financial performance in real-time and compare it with their projected results. You can analyze the revenue metrics and track the differences between the actual revenue figures and the forecasted projections in real-time. This empowers you to identify discrepancies and make faster business decisions—all aimed at driving "profitable growth".

Spreadsheets vs Revenue software: What to use?

Revenue planning has become more collaborative, data-driven, and agile. However, many organizations rely on spreadsheets to deliver multi-million dollar revenue forecasts because most finance and sales professionals have a long history of working with them.

Although spreadsheets are a valuable and popular personal productivity tool, they are not designed to overcome the issues organizations face when charting future growth using Excel or Google Sheets. Information can quickly become siloed, and teams can become isolated in their thinking. Everything, including data and formulas, must be entered into a spreadsheet manually, creating an accuracy problem. While spreadsheets have improved over the years, they’re still not ideal for large-scale financial planning and analysis.

Find yourself struggling with managing spreadsheets, a1nd the thought of running yet another quarterly forecast in Excel makes you wish there was a better solution? It may be time to consider using revenue forecasting software. Third-generation revenue planning and forecasting software helps finance teams perform multidimensional analysis for faster insights into sales performance and the pipeline funnel. They can also create multiple scenarios on the fly.

The below analysis of revenue planning software features sheds light on the development of each of these tools in terms of their capabilities for revenue planning. Here, we’ll take a look at how far each tool has evolved from spreadsheets.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| Web application that replaces spreadsheets | ||||||

| Web application that integrates with spreadsheets | ||||||

| Application uses a spreadsheet for calculations | ||||||

| Add-in for spreadsheet applications |

Source: Adapted from FP&A software classifications developed by Paul Barnhurst (The FP&A Guy).

We didn’t have to wrestle with spreadsheets anymore,” says Abhishek. “With a single source of truth and a familiar Excel-like interface, Drivetrain instantly clicked with department heads. They didn’t need to rely on us (finance team) for budgets or variance reports which were completely automated now. It empowered everyone across the organization to be more autonomous and increased accountability.— Whatfix

Real-world applications of Drivetrain in Revenue planning and forecasting

80% of sales organizations miss the mark on revenue forecasting by 25% or more. Access to accurate data is a key enabler to finance productivity and forecast accuracy. This is where Mindtickle faced significant challenges too. With scattered information across multiple systems, there was limited visibility into key metrics.

By automating the data gathering and consolidation process, Drivetrain enabled the team with a real-time view of critical business metrics. The platform seamlessly integrated with various data sources, including Salesforce, NetSuite, and BambooHR, replacing manual processes. This not only eliminated the challenges of scattered data but also ensured accuracy and reliability.

Drivetrain clearly shows us how the conditions are changing so that we can adjust our forecasts. Our model is based on trailing data that goes back up to four quarters. So, as average deal cycle times, win rates, and deal sizes change, we are able to recalibrate quickly and adjust our forecasts and guidance for the quarters ahead— Aman Bafna, Manager - Office of the CEO, Mindtickle

Drivetrain also emerged as a key enabler in Mindtickle's revenue planning strategy. Mindtickle saw a massive shift from static planning processes and cumbersome Excel sheets to a dynamic and collaborative approach. With over 35 users contributing to revenue planning and related processes, Drivetrain served as the central hub for lead generation planning, deal pipeline forecasting, and more.

With a single source of truth, mindtickle can now access precise numbers at any given moment. allowing for quick decision-making and reducing the time spent on data-related tasks.

Features

1. Native Integrations

A revenue software generates forecasts by taking into account all relevant factors, including historical data and the latest trends. The more information your platform has, the more accurate and reliable the forecasts. Integrating your chosen revenue platform with CRM, ERP and accounting software enables seamless data flow between systems. This ensures that forecast models have access to up-to-date information on sales pipelines, customer accounts, billing history, and financial transactions ultimately leading to accurate forecasts, increased efficiency and better insights.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| Native integrations with top 6 ERPs | ||||||

| Native integrations with top CRM, HRIS, Billing & BI tools | ||||||

| Integration with Excel and Google Sheets | ||||||

| Excel/CSV upload download |

2. Multi-dimensional revenue modeling and forecasting

The ideal revenue platform should allow you to model and plan the targets by adjusting assumptions and variables to perform scenario analysis and sensitivity testing. It should also provide customization options and configurable parameters so the forecasting models are trained as per your specific business requirements. This ensures that forecasts accurately reflect the nuances of your business.

Also, if you want your business to scale, you need to adopt everything that aids your objective, including your revenue software. As your company grows and evolves, your platform must be robust enough to stay in tandem with the rising complexity of financial transactions. It should be able to handle large datasets without crashing or slowing down.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| In-Memory Multidimensional Calculation Engine | ||||||

| Rolling forecast | ||||||

| Driver based forecasting | ||||||

| Multi subsidiary consolidation | ||||||

| Multiple scenario planning | ||||||

| Sales capacity planning | ||||||

| Sales quota planning | ||||||

| Incentive compensation management | ||||||

| Territory planning |

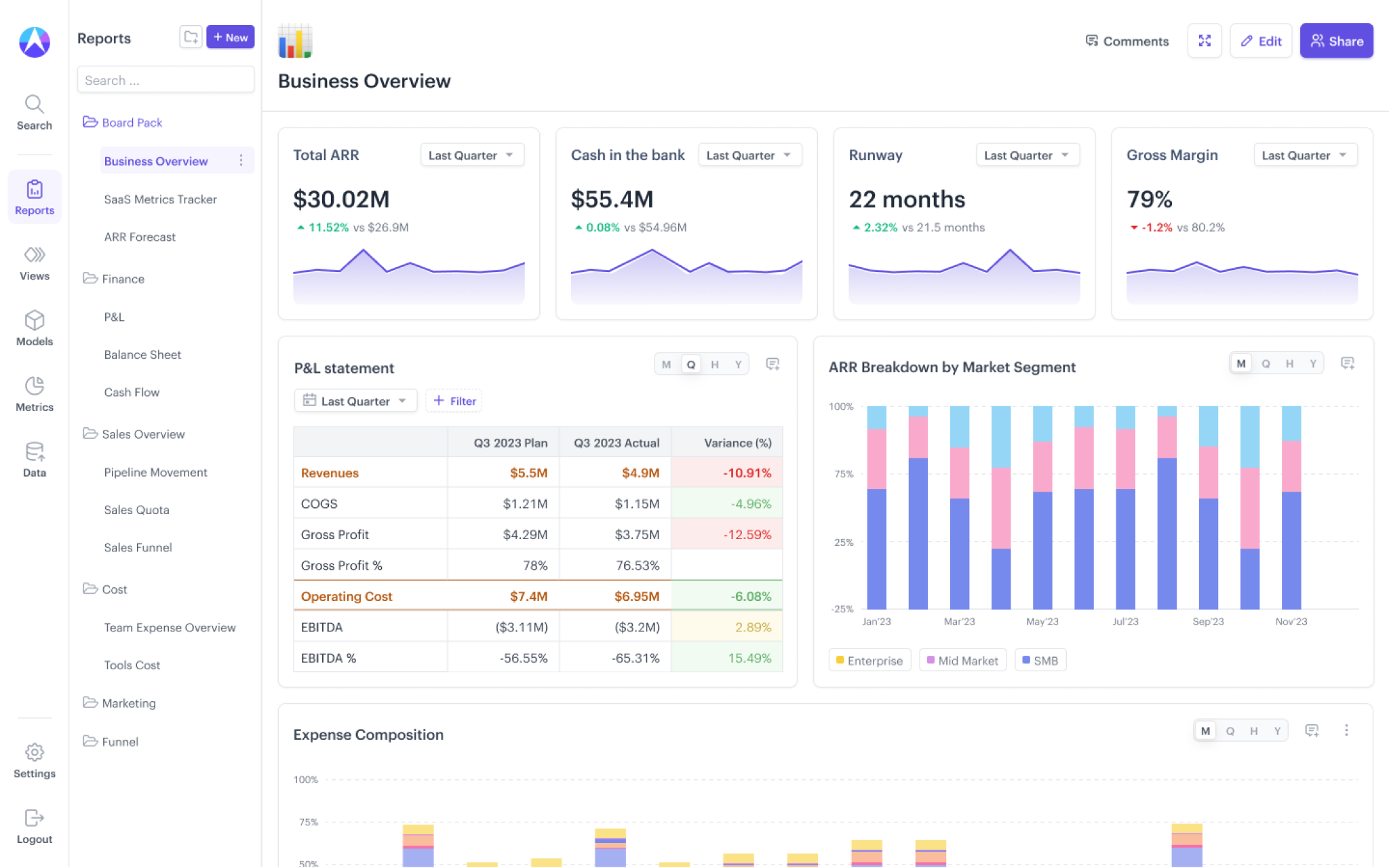

3. Automated reporting and dynamic dashboards

Interactive or dynamic dashboards enable finance pros to answer critical higher-order questions on-demand with up-to-date data. They allow you to drill down to the transactional level to and also drill down by any available dimension in your dataset across data sources. This feature is a must when it comes to revenue forecasts as it’s essential to understand what’s driving growth or why there’s a gap between the target and actuals.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| Drill down to transaction level | ||||||

| Drill down by any dimension | ||||||

| Global- and chart-level filters | ||||||

| Text callouts/notes in dashboards | ||||||

| Reporting templates | unknown | unknown |

4. Security & compliance

Another feature to consider when assessing new revenue tools is whether or not they maintain a high-quality audit trail. This feature can make all the difference between the successful operation of internal controls and control deficiencies. A detailed audit trail is often a regulatory requirement. Even when not mandated, they are a business, data security, and privacy best practice.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| SOC 2 Type II | ||||||

| ISO 27001 | unknown | |||||

| Fine-Grained Role Based Access Control | ||||||

| Audit trails |

5.Onboarding, training & customer success

Handling financial and operational data isn’t easy and can prove intimidating for non-finance users. A great onboarding experience, a self-service oriented and intuitive interface where users can manage their datasets, metrics, models and user access, reduces friction. These features also ensure quicker resolution to queries and, thus, reduced time to value.

| Software/ Platform | Drivetrain | Vena | Cube | Planful | Workday Adaptive Planning | Anaplan |

|---|---|---|---|---|---|---|

| Implementation time | 4-6 weeks | > 2 months | >2 months | >3 months | > 4 months | > 6 months |

| In-house implementation | Yes | No | unknown | No | No | No |

| White-glove onboarding | ||||||

| Self-service management (admin) | ||||||

| Dedicated customer support/success |

FAQ

1. What is sales revenue forecast?

A sales forecast estimates the expected sales revenue within a specific period, such as quarterly, monthly, or yearly. It considers various factors, including historical sales data, market trends, potential customer behavior, and external influences to forecast how much revenue a company plans to generate.